Apple has to be one of the most influential companies of all time. The next big product from Apple is not an iPhone or MacBook but it is a financial service.

[fvplayer id=”477″]

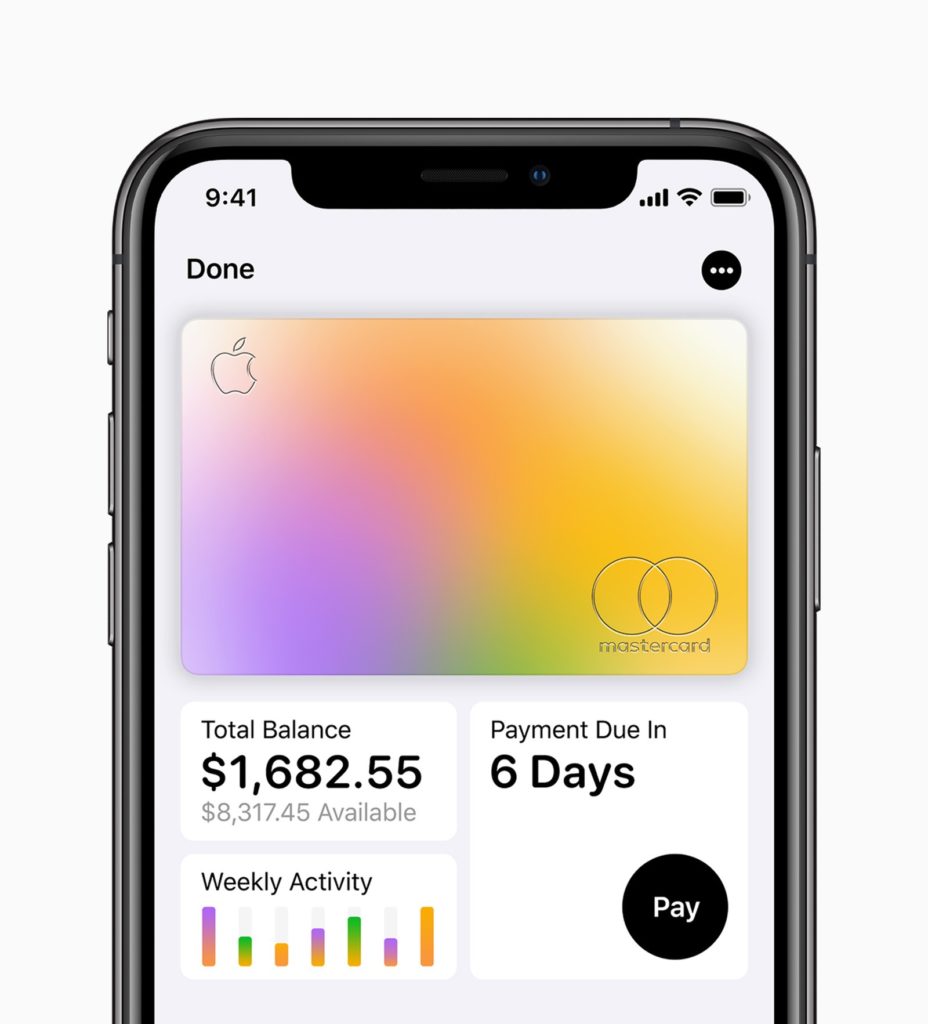

Apple Card is a credit card that is tied to Apple Pay and can be used to complete payments both online and offline. The Cupertino based tech giant has partnered with Mastercard and Goldman Sachs to release their new card.

Apple Card will be acceptable worldwide.

Apple Card Feature

The card will be available virtually in the Apple Pay as soon as the user is approved. The physical version of the card is made of titanium and can be activated by tapping it to the iPhone with a virtual card.

Apple is known for its stand on user security and privacy and this credit is no exception. The card will not have any account information printed on it.

The card has a unique device number which will be locked on the iPhone. Users will require that device number and one-time password which will be generated from the Touch ID or Face ID of the device to complete a transaction.

TechCrunch reported that users will be able to generate a new credit card number for situations in which they don’t want to disclose their information.

Financial Aspects

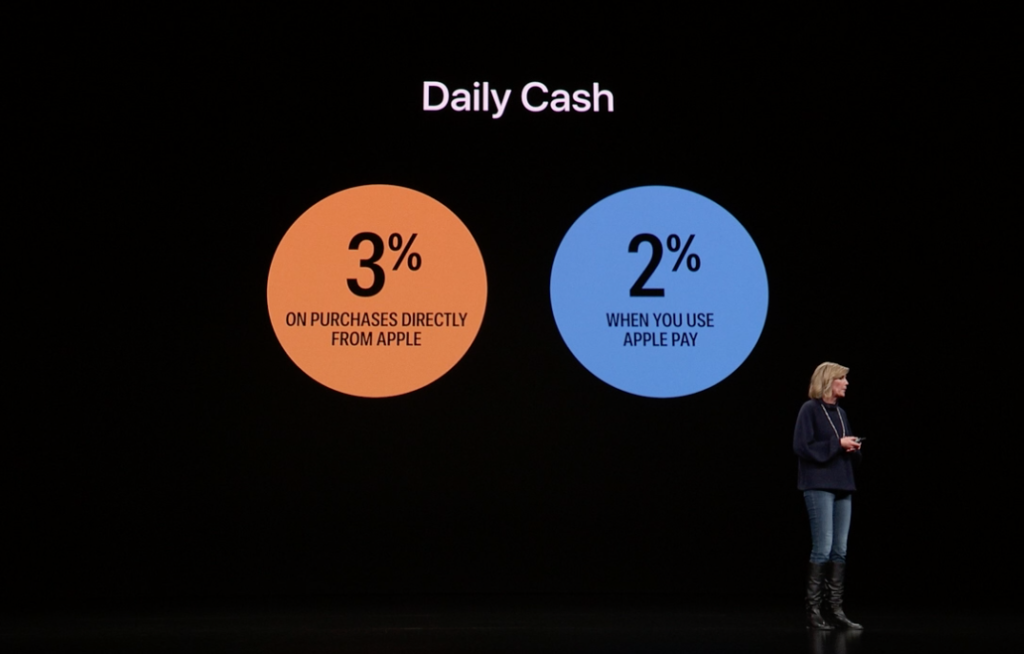

Apple will not charge any late, annual, international or over-limit fees. Apple will also offer cash back reward daily to the users.

The company will reward a 3% daily cash back for the purchase made directly,2% for the payment made by virtual card. Users will get 1% cash back on the use of physical cards.

Even though Apple CEO Tim Cook praised the Apple Card industry analysts were underwhelmed by the offerings.

https://youtu.be/HAZiE9NtRfs