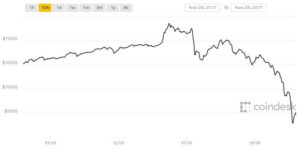

Falling off seven days of substantial misfortunes, bitcoin fell as much as 10 percent and set a crisp low at $3,447.58 on Sunday, as indicated by information from CoinDesk. That was the digital currency’s least dimension since September 2017. It later recuperated to generally $3,945 starting at 6 p.m. ET.

More than seven days, bitcoin has now lost in excess of 35 percent of its esteem, as per CoinDesk. This denotes its greatest one-week drop since April 2013, when the digital currency fell in excess of 44 percent, as per CoinDesk.

The November misfortunes are a striking inversion from bitcoin’s shockingly steady October. The cryptographic money had been exchanging easily in the $6,400 territory following an unstable year, while major U.S. securities exchanges varied.

The weekend misfortunes convey bitcoin’s year-to-date drop to in excess of 75 percent. Significant digital currencies XRP and Ether were down as much as 12 and 9 percent individually.

The Securities and Exchange Commission reported its first thoughtful punishments against digital currency organizers a week ago as a feature of a wide administrative and legitimate crackdown on misrepresentation and maltreatment in the business.

A week ago, Bloomberg News announced that controllers are examining whether bitcoin’s rally to nearly $20,000 a year ago was the aftereffect of market control. The U.S. Equity Department is exploring whether tie, a questionable digital money that originators say is supported 1:1 by the U.S. dollar, was utilized by brokers to prop up bitcoin, as indicated by the report, which refered to three anonymous sources acquainted with the issue.

Source: Coindesk and CNBC