Bitcoin Mining is a trend which is on a decline for quite some time now. After the ‘Crypto-Winter’ of 2018, cryptocurrency prices are on a constant downtrend. However, while all that happens, Bitcoin Mining is improving in one aspect: decentralization.

While the Bitcoin mining costs are on a steady rise and Bitcoin price on a downtrend, this is one of the rare bits of good news. Let us take a closer look at what this means – and the impact of this on Bitcoin miners.

What Does Bitcoin Mining Getting Decentralized Mean?

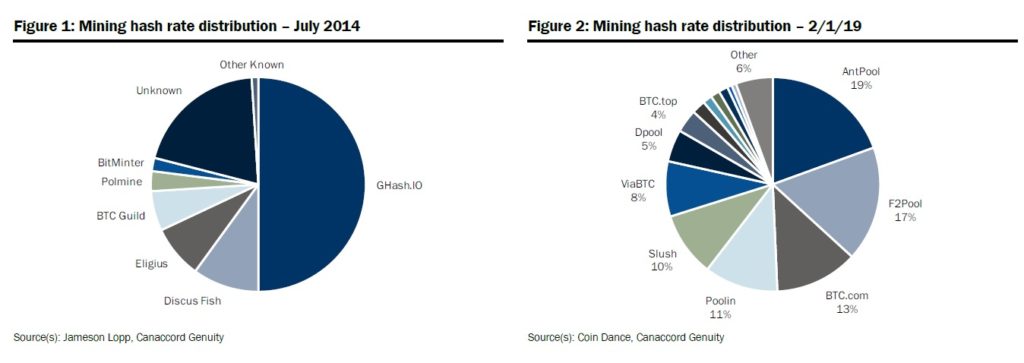

Reports from Canaccord, a Canadian Wealth Management company, point out that the distribution of Bitcoin’s hash rate is getting wider. Basically, a number of different mining pools are mining for Bitcoins. This ensures that no singular entity holds a lot of power.

To compare this with 2014, Bitcoin Mining pool GHash controlled 50% of the mining markets. However, as of today, 19% is the highest any pool holds. Moreover, this is good news for the markets as cryptocurrencies were created to decentralize the flow of money.

A Look At The Biggest Bitcoin Mining Pools

AntPool has emerged as the biggest pool for mining Bitcoins. It currently holds the largest portion of the market share. AntPool is owned by cryptocurrency mining equipment manufacturing giant Bitmain. AntPool’s hash rate is currently 19%.

This is followed by F2Pool, which has a hash rate of 17%, BTC.com with a hash rate of 13%, Poolin with 11% and Slush with 10%. The image above gives an accurate comparison of how mining has become decentralized.