The escalating trade war between the two countries is likely to affect the US bond market, and China will end up selling off US treasuries. However, crypto experts claim that this move might help in soaring the prices of Bitcoin and other cryptocurrencies.

[fvplayer id=”1731″]

The trade war between the two countries started with tariff, but it looks like this trade war has spread to the tech industry. The recent ban by the US Government on Huewi has only added fuel to the fire.

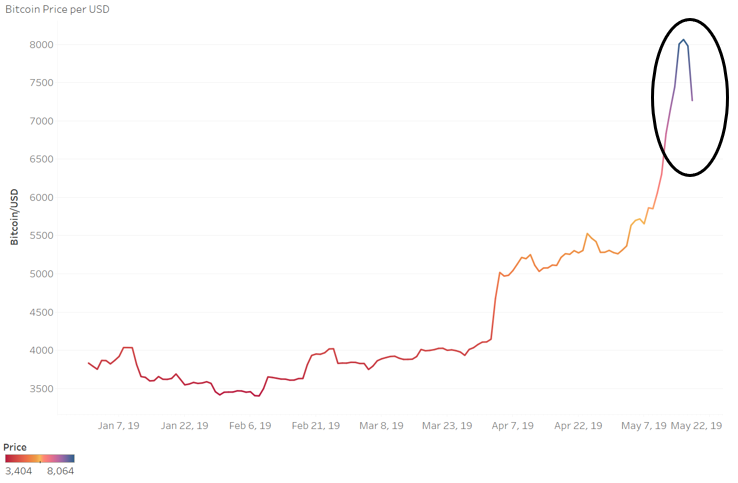

Interestingly, while looking at the data, it looks like this trade war has benefitted the Bitcoin as it has become the new gold. According to the data, Bitcoin has grown by 132.69 percent, and other cryptocurrencies and altcoins followed suit.

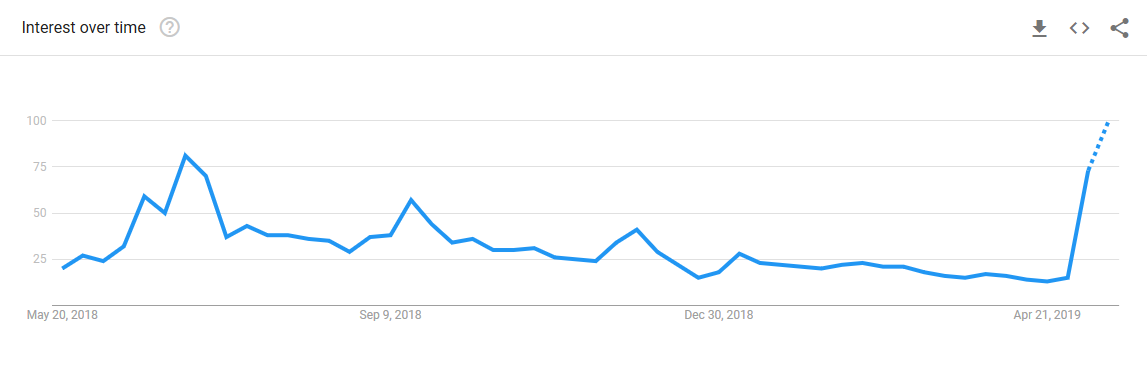

While looking at the Google Trends data we found out that during the last trade war escalation number of searches for bitcoin increased.

The search for Bitcoin peaked in 2019 when both the countries started the trade war. The chart shows that interest of people in Bitcoin rose tremendously in 2019.

The Simultaneous Movement of Bitcoin Price and Search

The interesting part is the price action of Bitcoin and Google searches. It clearly suggests that people are looking to invest and store their financial assets in a form which is not affected by the geopolitics.

For many years US Treasury has served this purpose while many geopolitical and global events occurred.

The actual reason is that China has around $1 trillion in US Treasuries as a part of the China dollar management plan. If the trade war continues, it is possible that China pulls out the bonds and it might move to bonds of other treasuries like Japan and Germany.

These developments clearly indicate that people are looking at Bitcoin for keeping their financial investments safe from the current tumultuous market.