The worldwide fervor about electric vehicles confronted a test in New York on Wednesday. After a rough begin, NIO Inc. saw a touch of speeding up. The Chinese upstart looking to go up against any semblance of Tesla Inc. begun exchanging on the New York Stock Exchange in the wake of raising about $1 billion offering American depositary shares at $6.26 each. The electric-vehicle creator, upheld by Tencent Holdings Ltd., valued the stock close to the low end of its offering in the midst of the tumult in Tesla shares, a worldwide exchange war and financial specialist second thoughts over its assembling abilities and benefit.

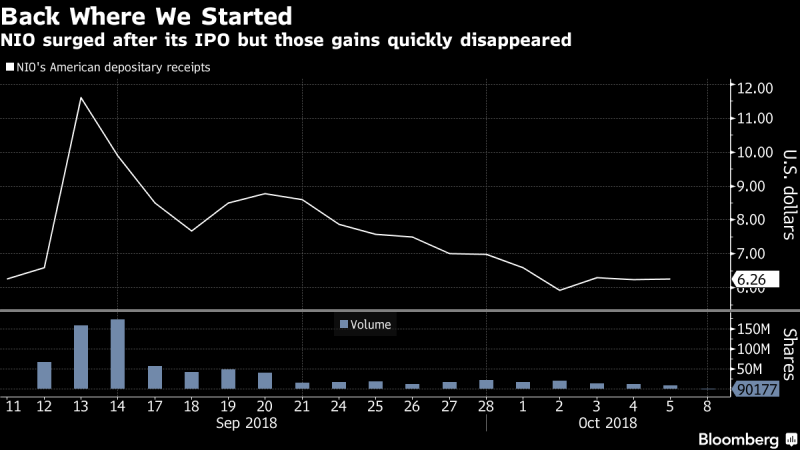

The offers opened in New York exchanging at $6 and immediately dropped as low as $5.35 before bouncing back. The offers shut at $6.60, up 5.4 percent. The deal, which at first esteemed NIO at about $6.4 billion, will test speculator hunger for electric-vehicle producers competing to wind up a homegrown response to Tesla in China, where government motivators have helped the nation turn into the world’s greatest market for clean-vitality vehicles. The IPO may likewise be a bellwether for a grasp of Chinese new businesses, for example, Byton and Xpeng Motors Technology Ltd., which mean to contend with BMW AG, Daimler AG in persuading clients to change to battery-fueled vehicles.

“We’re idealistic about the possibilities of local electric-vehicle producers,” said Xu Dalai, a CEO of Shunwei Capital Ltd., an early speculator in NIO. “We accept there are chances for new businesses to change and disturb the entire business with advancements. China will see its very own group of unicorn organizations emerging. NIO is among them.” The offering was driven by banks including Morgan Stanley, Goldman Sachs Group Inc., and JPMorgan Chase and Co., which have an option to purchase 24 million extra offers to cover over-allocations. The offers will exchange on the New York Stock Exchange under the image NIO. “The posting of the 4-year-old NEV producer in China, with no assembling permit of its own, is a solid sign that speculators have tolerant hazard hunger for the prospering China NEV showcase,” said Steve Man, an investigator at Bloomberg Intelligence in Hong Kong. “The development is sponsored by positive Chinese strategies for the business.”

Source: Bloomberg