Esther is a mom from South Africa. She co-founded Malkia Invest, a black women-owned investment company, after 10 years of experience in Development Finance and Banking.

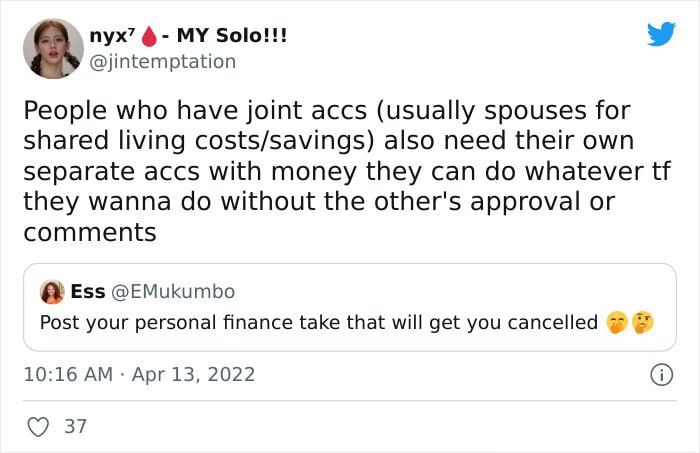

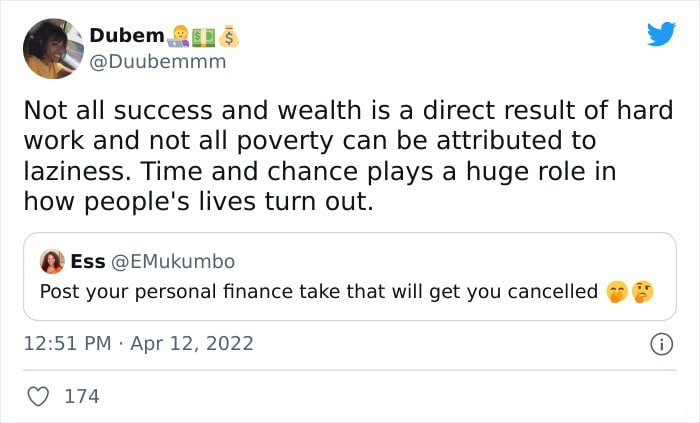

Esther frequently posts on social media while trying to achieve her goals and one of her latest posts has gone viral. People happily obliged when the woman asked them to share their most controversial takes on personal finance.

Money is a subject that many people shy away from in the real world, fearing making a fool of themselves or saying something that would make them angry. The internet is wonderful!

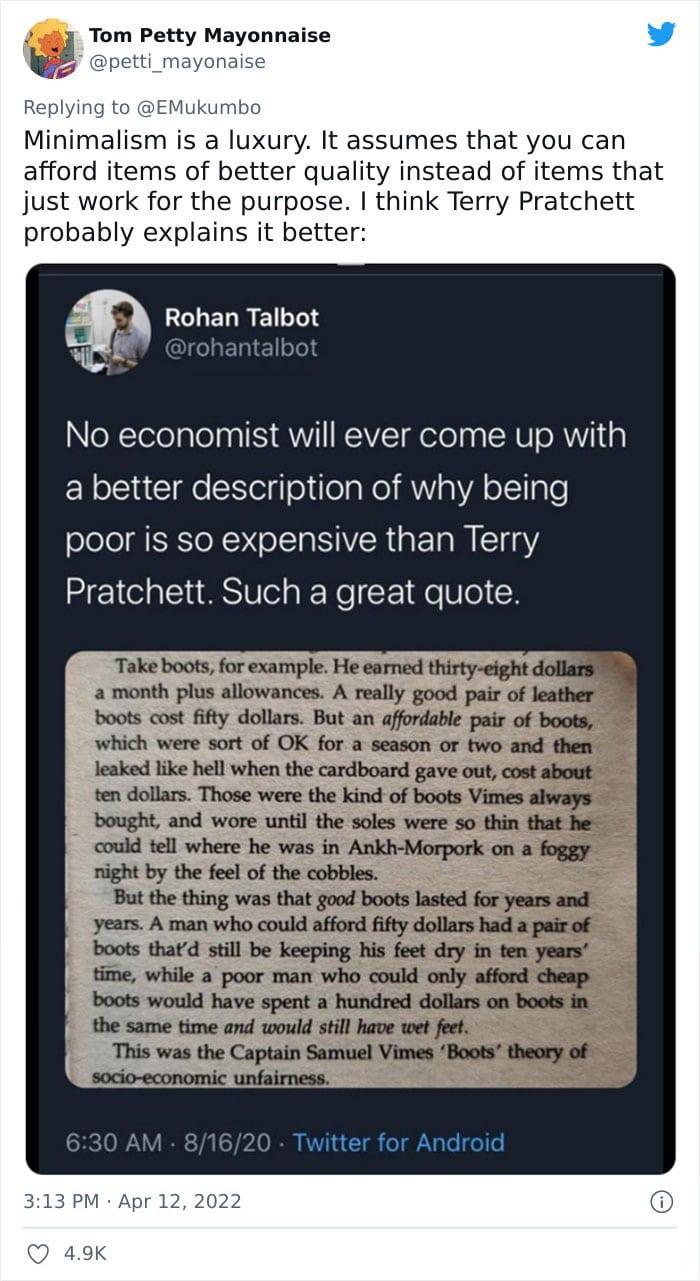

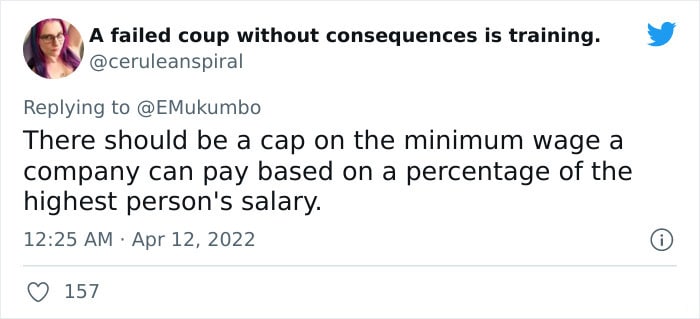

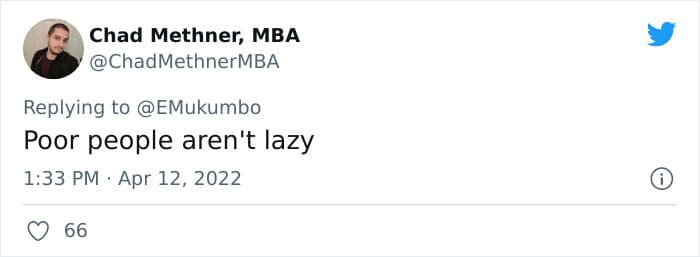

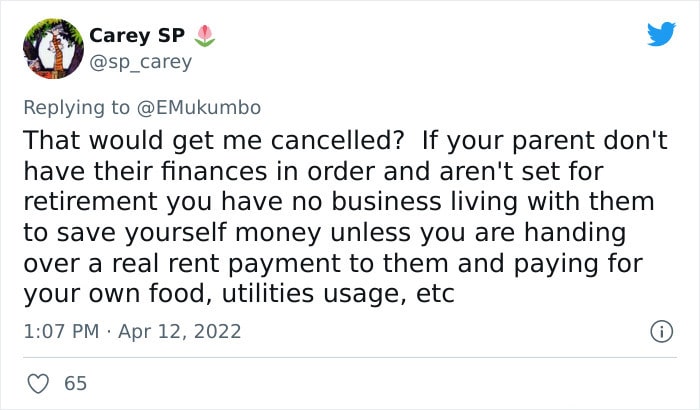

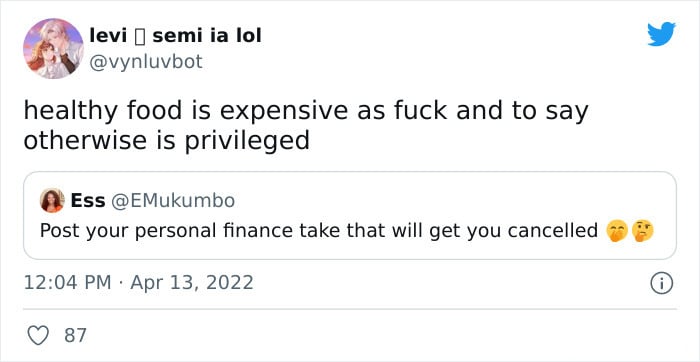

1.

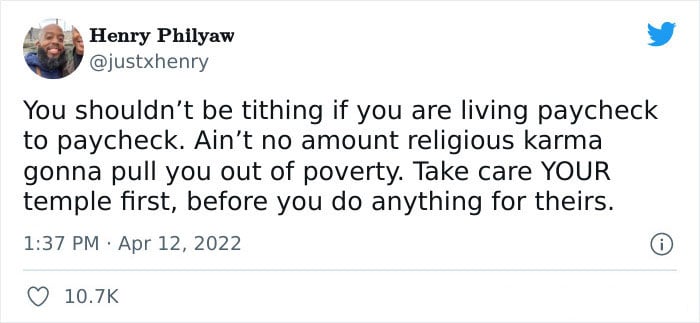

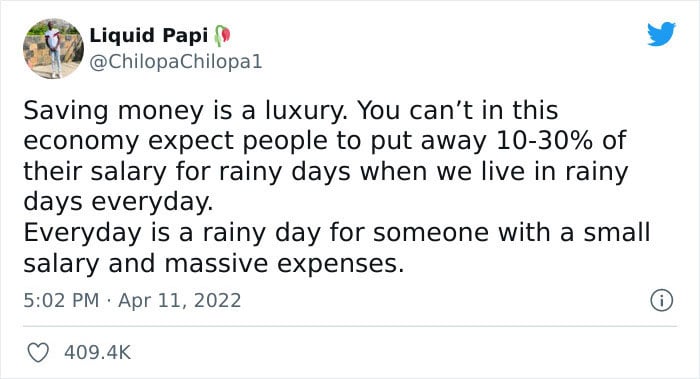

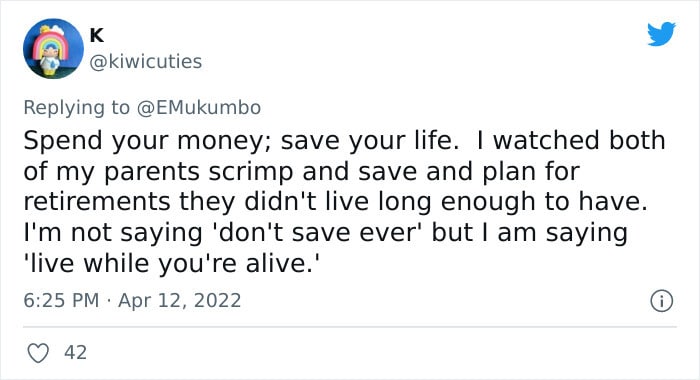

2.

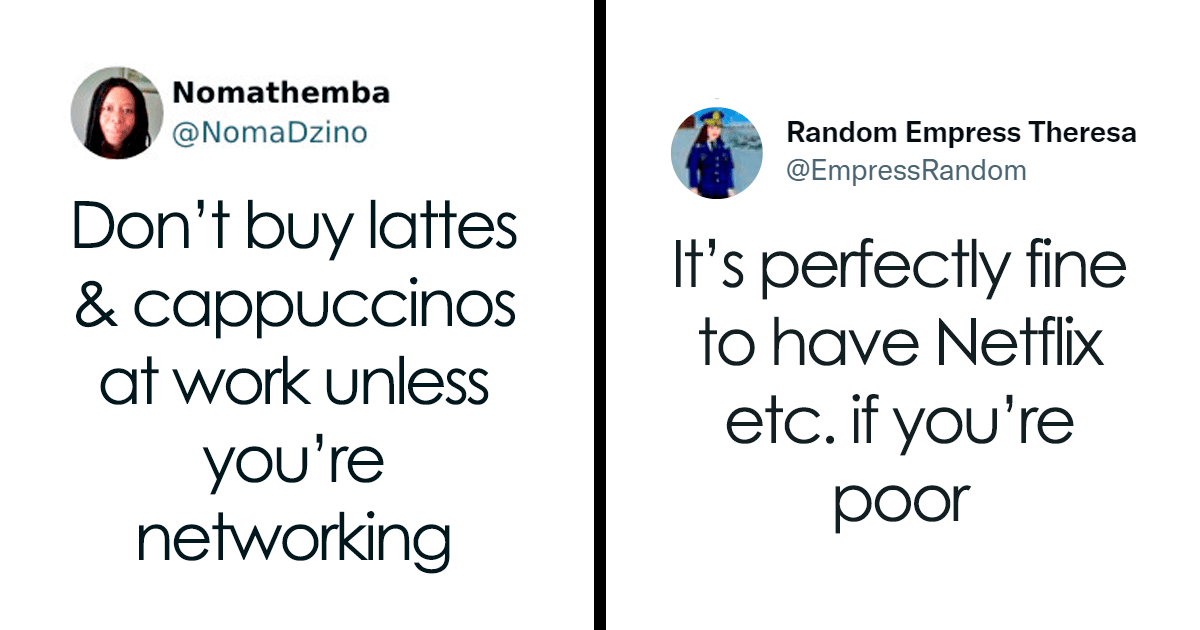

Let’s challenge this thread from a different point of view. It might allow us to get a better understanding of what these people are saying. Traditional personal finance advice is often thrown around in blanket statements. The way we deal with money is often much more nuanced than we think.

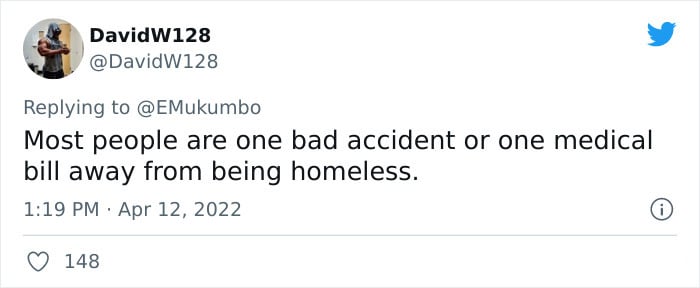

Wage growth has been slow, and income inequality is still a problem, despite the fact that consumer spending is increasing and unemployment rates have fallen. With the situation changing so fast, what can we do about money?

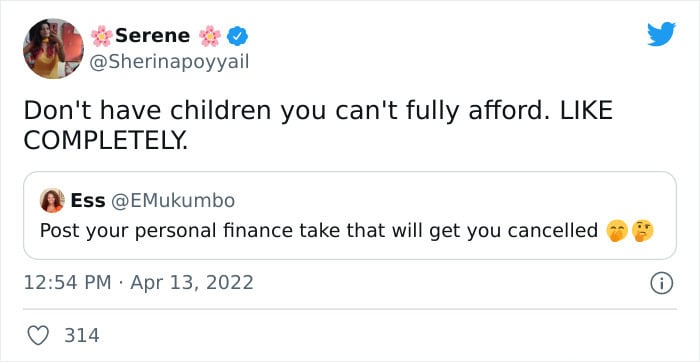

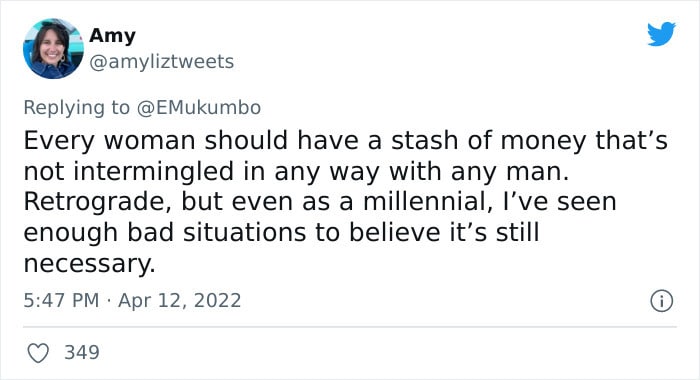

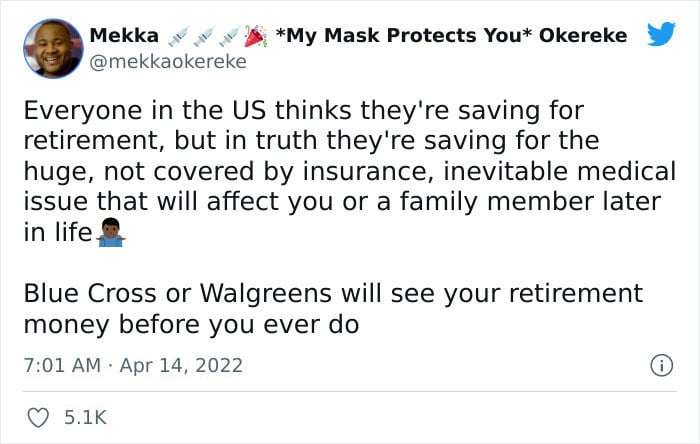

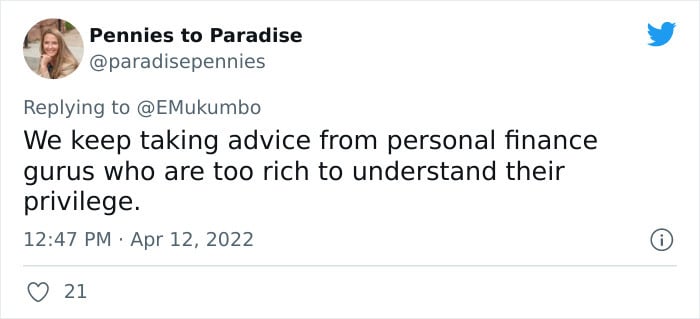

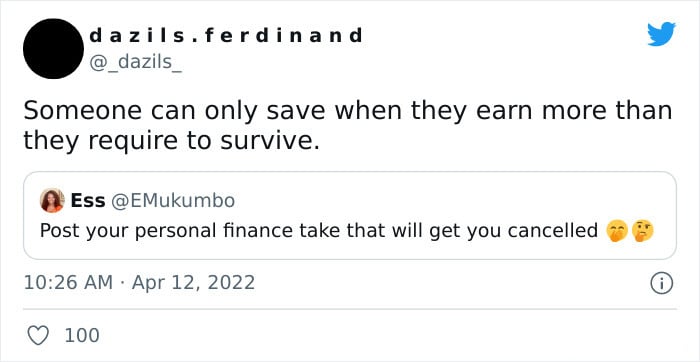

3.

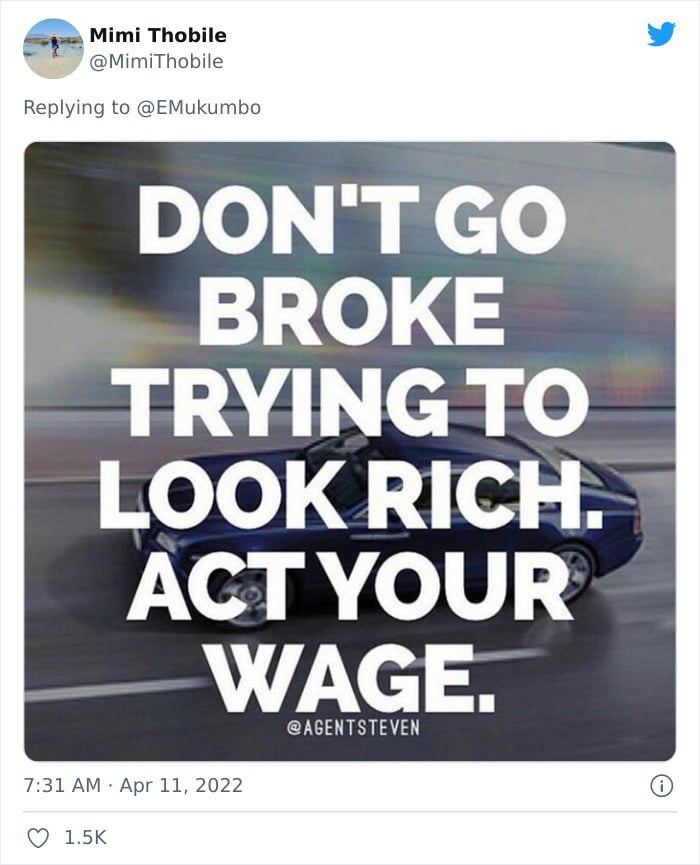

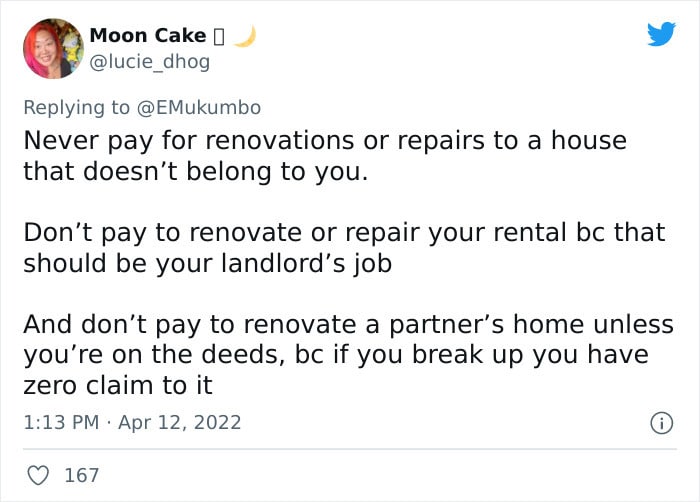

4.

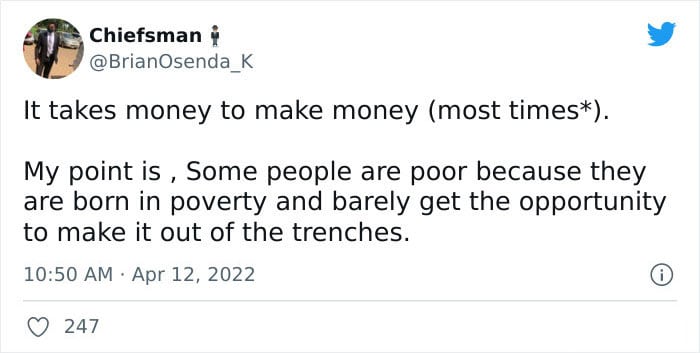

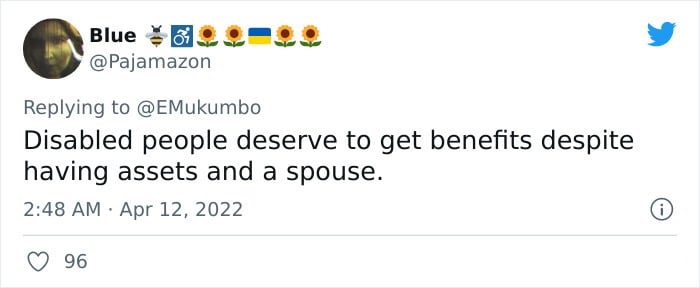

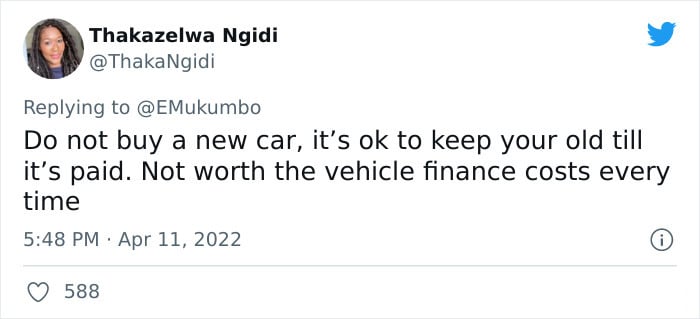

5.

“I’m interested in the causes and consequences of inequality, particularly from a labor market perspective,” Kate Bahn, director of labor market policy and an economist at the research organization Washington Center for Equitable Growth, told Wong. Dr. Bahn said there isn’t enough emphasis on the larger structural barriers that make people’s financial lives difficult. She said personal finance might even further de-emphasize these barriers.

When a single hiring entity gains control over the workforce, there is a concept called labor monopsony.

“So employers will take advantage and pay workers less because there’s nowhere else to go,” Dr. Bahn said. “It’s geographically remote areas where there may be only one big employer, and there’s no other company to work for, so that company can pay whatever they want because workers can’t say, ‘Screw this,’ and go somewhere else.”

6.

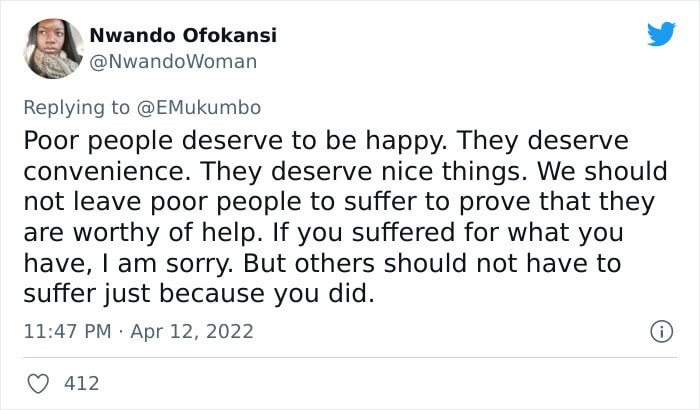

7.

8.

9.

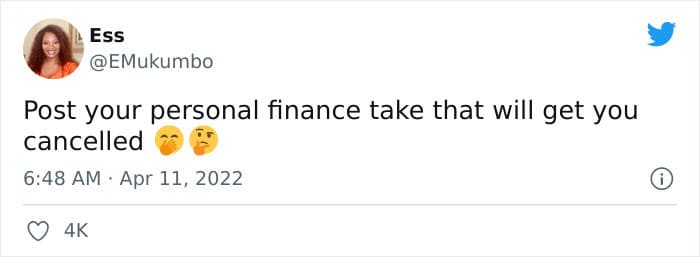

Personal finance is necessary, but not enough according to Dr. Bahn’s argument. She said that it’s put forth as a solution when the policy is what we really need and places priority on personal choice over issues that are out of most people’s control.

Many people think that personal finance is still helpful because it is a way to share information that is discouraged from seeking. “People have criticized financial education, saying it doesn’t work because people are still making mistakes,” Billy Hensley, president, and CEO at a private nonprofit, National Endowment for Financial Education, also told Wong. “Education can’t help access jobs, but it can help people navigate the system as it exists.”

10.

11.

12.

13.

How do you measure the effectiveness of personal finance? So much of it is personal.

Rachel Schneider, a specialist and co-creator of The Financial Diaries: How American Families Cope in a World of Uncertainty, attempted to see how individuals handle cash in reality. She and her co-creator, Jonathan Morduch, a specialist and teacher at N.Y.U., worked with north of 200 families for a year, gathering data on each dollar that went all through their homes.

14.

15.

16.

17.

“A huge finding was the level of volatility people experience in their financial lives over the course of a year,” Ms. Schneider explained.

She was surprised to see how much income varied within a year. A person could be above the poverty line for the year, but still, be below the poverty line in a given month.

18.

19.

20.

21.

“This has a huge impact on how people deal with money,” Schneider said. “The economy has been growing and the unemployment rate is relatively low and declining, yet we’re not seeing that growth and prosperity getting distributed down to the bottom.”

Schneider worried that overemphasizing financial education as a solution to financial challenges would shift responsibility away from our economy’s major players, like banks that offer predatory loans or companies that take advantage of workers.

22.

23.

24.

25.

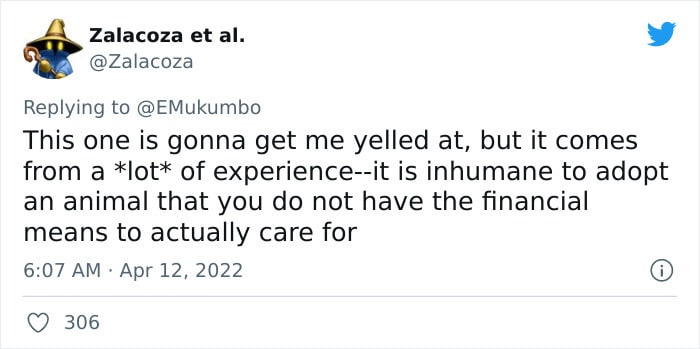

The way we talk about money has to evolve if we’re going to help people navigate the current system.

Financial education shouldn’t tell a person to do this in a certain way or they will be a failure. We need to acknowledge the individual and humanize the topic.

26.

27.

28.

29.

30.