Goldman Sachs recently reports its revenue for quarter one of the current fiscal year. It fails to match the expectations of the analysts. Moreover, it could have been in more loss. Find out what the investment bank to avoid profit loss here.

[fvplayer id=”241″]

Goldman Sachs: First quarter performance

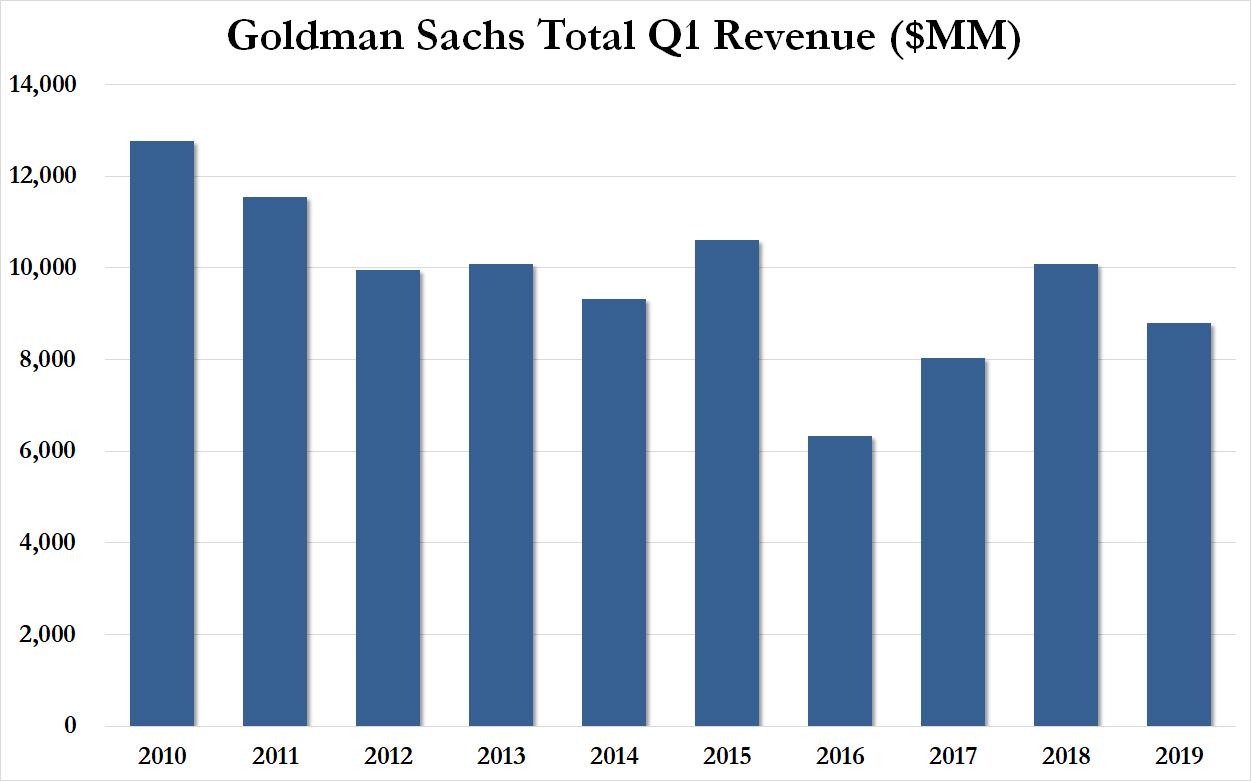

The world’s largest investment bank fails to meet the expectations of the analysts. This is in terms of revenue. Goldman Sachs announces its first-quarter revenue. It is $8.81 billion as per the bank.

This amount is 13 percent less than the first quarter of 2018. Moreover, it is also below the expectations of the analysts.

However, Goldman Sachs managed to surpass the expectations of a profit of analysts. The expectations were of $4.89. However, the investment bank managed a $5.71 per share.

Investment bank slashes salary

The investment bank slashed salaries of its employees. The employee compensations and other benefits were reduced to 20 percent. Because of this cut, the net value is $3.26 billion. This, therefore, helped the bank to outstrip the decline in the revenue of the bank.

The reduction is of $90,780. Moreover, this is for each of the current roasters of the employees of Goldman Sachs. The number of employees at the bank is 35,900.

In 2018, this number was 34,000. Moreover, the pay and benefits for them accounted for $119,323 then.

This strategy adopted by the bank help it saved loss over the profit. Moreover, the expectations of the analysts were also surpassed.

The profits of the bank witnesses a fall of 21 percent. This has reached a value of $2.25 billion. The bank struggles to make money. This is because of the trade war between China and the United States. Moreover, the recent shutdown also contributed to the same.

Therefore, this slash in compensation, helped the bank a lot. It saves the bank from a 24 percent decline in the revenue. Moreover, an 11 percent decrease in bonds and currency.