Couples can achieve more when they work together. If you’re in a serious commitment, you should have a calm and honest discussion with your partner. When people skip it and enter discussions about money only when there is a problem, their ego can take control of the situation and seriously damage the relationship. Even a wedding.

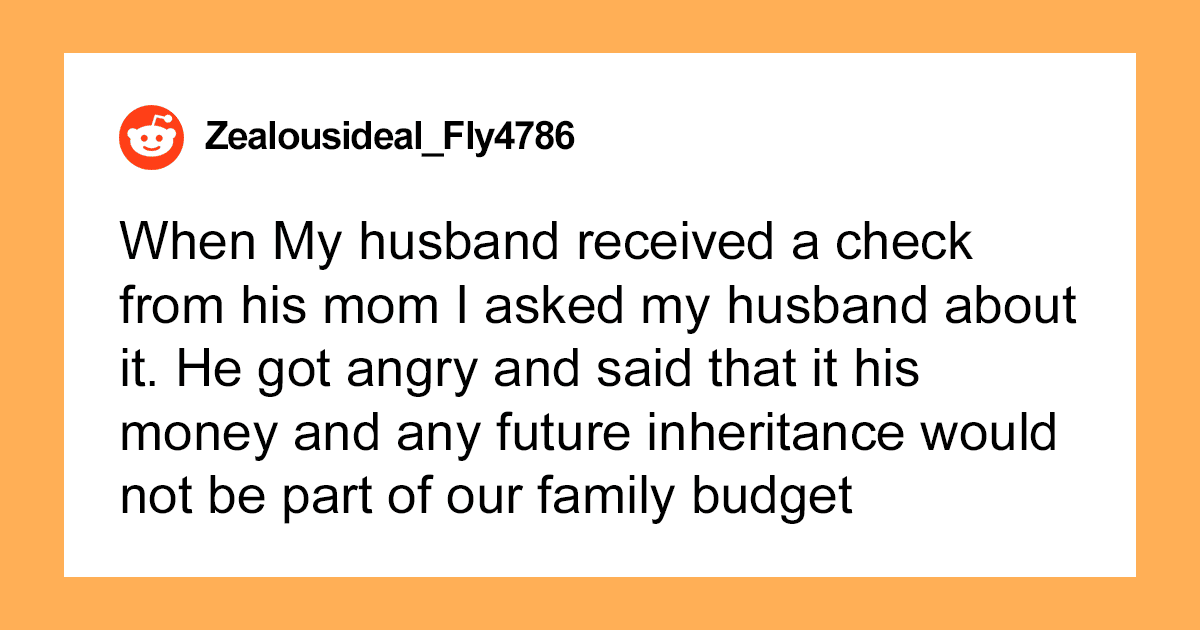

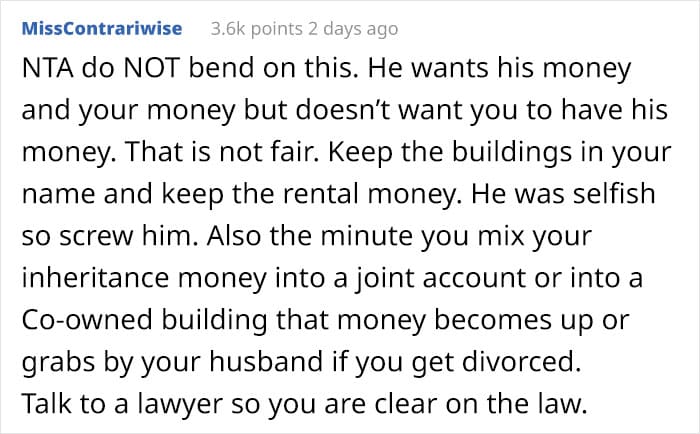

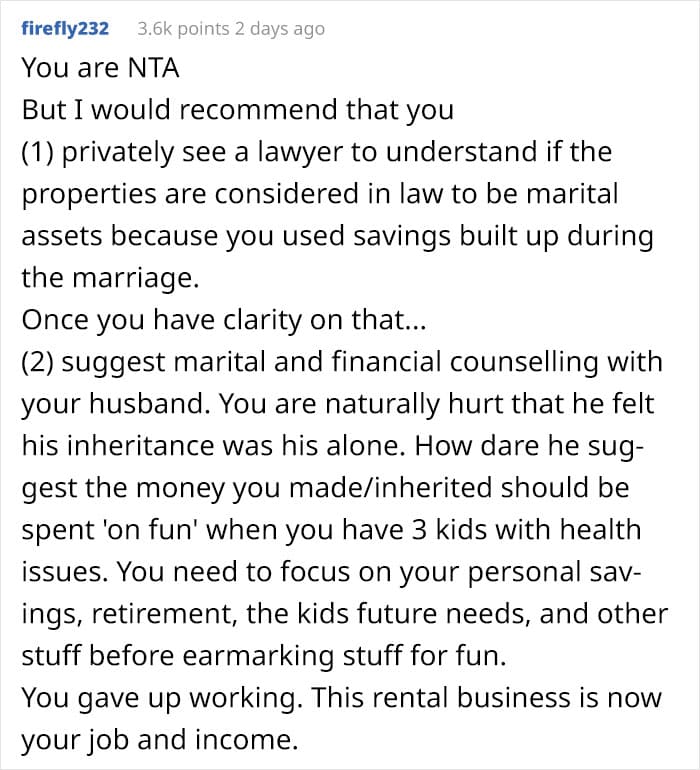

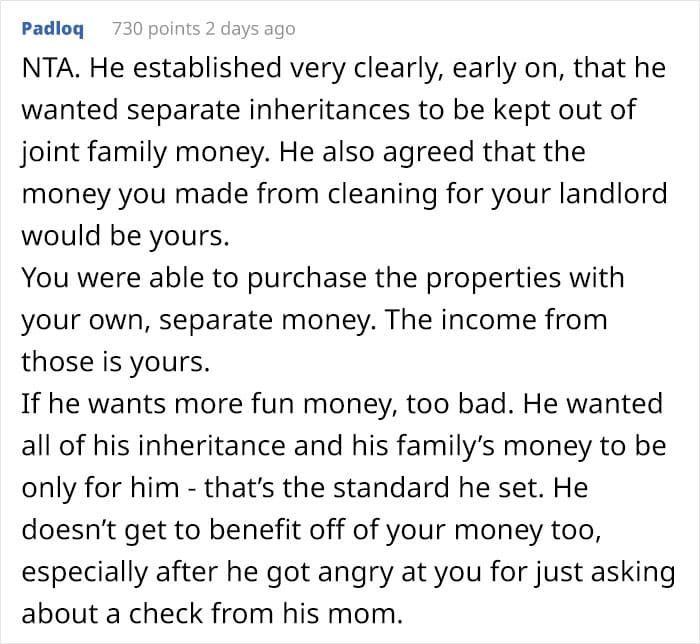

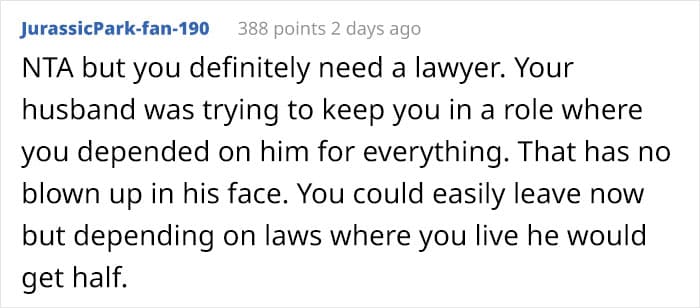

A few days ago, a post was submitted to the “Am I The [Jerk]?” community that perfectly illustrates this tricky and dangerous situation. The woman describes how her partner used her savings and inheritance against her, breaking the rules he himself had established. The story shows how important communication is to understand one another and that having a policy agreed upon in advance is more effective than trying to put it together on the go.

A woman with a small fortune got into a fight with her partner.

The internet was asked to evaluate her decisions.

Experts at Investopedia put together some of the most common issues and challenges to look out for to help pave the way to better marital finances and relationships.

1. What’s Mine, Yours, Ours. Sometimes, when each spouse works and they can’t agree on financial nuances or find the time to talk about them, they split the bills down the middle. Each spouse can spend what they want when the bills are paid. It seems like a reasonable plan, but it can build resentment over individual purchases. Spending power is divided, as well as the financial value of marriage, and the ability to plan for long-term goals such as buying a home or securing retirement. It can lead to financial infidelity if one spouse hides money from the other.

Bill parting additionally pushes not too far off any preparation and agreement working with regards to how monetary weights will be taken care of on the off chance that one mate loses employment; chooses to scale back hours or accept a decrease in salary to evaluate another vocation; passes on the labor force to bring up youngsters, return to school, or care for a parent; or then again assuming there’s some other circumstance in which one accomplice might need to monetarily uphold the other. Before any of them happen, couples need to have a conversation about them.

2. Debt. Most people come to the altar with a lot of financial baggage. If one partner has more debt than the other, there can be sparks flying when discussions about income, spending, and debt servicing come up.

Debts brought into a marriage stay with the person who incurred them and is not extended to a spouse. It won’t hurt your credit rating, which is linked to Social Security numbers and tracked individually. Most states that operate under common law owe debts incurred after marriage to both spouses.

All property and debts are shared after marriage in nine states. They are Arizona, California, Nevada, Idaho, Washington, New Mexico, Texas, Louisiana, and Wisconsin. You are not liable for most of your spouse’s debt that was incurred before marriage, but any debt incurred after the wedding is automatically shared.

3. Personality. Money discussions and habits can be influenced by personality. If both partners are debt-free, the age-old conflict between spenders and savers can play out in many ways. It’s important to know what your money personality is and to discuss it openly with your partner.

Some people are cheapskates and risk-averse, some are big spenders and like to make a statement, and others take pleasure in shopping and buying. Some are natural investors who delay satisfaction for future self-sufficiency while others rack up debt. Many of us may display more than one of these characteristics at a given time, but will usually revert to one main type. It is best to recognize bad habits, address them, and moderate them if you and your spouse are close to each other.

4. Power Plays. There are power plays that occur in these scenarios:

- One partner has a paid job while the other does not.

- One of the partners is out of work.

- One spouse makes more money than the other.

- One partner comes from a family with money while the other doesn’t.

The money earner wants to dictate the couple’s spending priorities when one or more of these situations is present. It is important that both partners work together as a team. It is not a solution to an unbalanced power/money dynamic in a marriage if you have a joint account.

5. Children. To have or not to have? That is usually the first question. Food, clothing, shelter, Little League, ballet, designer jeans, prom gowns, minivans, and college are all child-related expenses. Expenses are not included for offspring who have already left the nest. Your kids will leave the nest. Some never do.

Having kids isn’t just about the cost. If one partner cuts their hours, works from home or leaves a career to raise children, couples should address how that changes marriage dynamics, assumptions about retirement, lifestyle, and more.

6. Extended Family. It can be difficult to co-manage finances and respect the goals, needs, and expectations of each spouse.

For example, her mom wants to go to Vegas. His parents don’t have a car. Her brother is not able to make the rent. His sister’s husband lost his job. One spouse is writing a check and the other wants to know why that money wasn’t used to address needs at home or fund a vacation for “us.

Family money dynamics are the same. He will be flown home for the holidays by his mom. Her mom will give her a new car because the one she is driving is a Honda. Her mom can’t afford to match the spending of her grandsons, so she buys extravagant gifts for them. The joys of a family can be found in your wallet.

It is impossible for two people to agree on everything. They can compromise and find a lesser evil if they talk to each other.

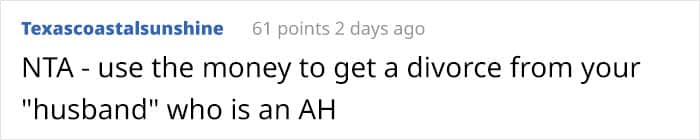

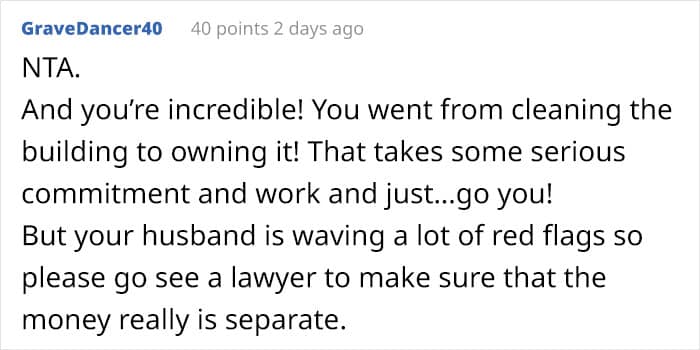

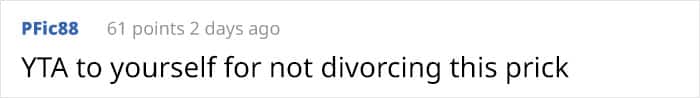

There is nothing wrong with the way the woman handled the situation.

She shared the latest developments after her story went viral.