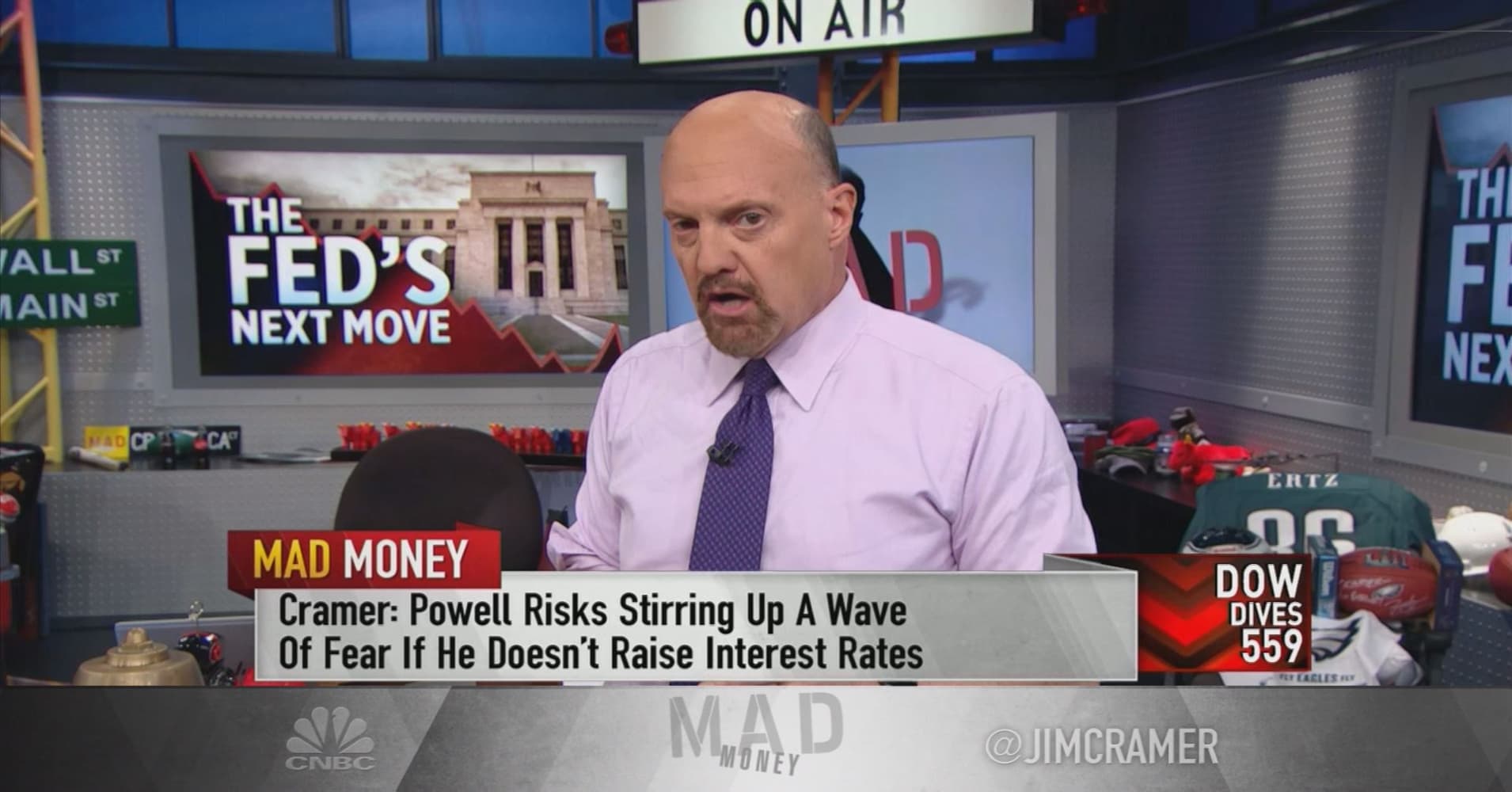

On Friday, Jim Cramer of CNBC stated that if the Federal Reserve reneges on its promise of hiking the interest rate in December which is widely anticipated, it will then cause a state of “panic” on the Wall Street.

Cramer stated that only because the chair person of the Federal Reserve, Jerome Powell has promised a hike in the rate, this risks of stirring the tide of fear among-st the investors if Powell fails to do the same.

Cramer made the statement as the prices of the stocks witnessed a fall because of the weaker than expected results for jobs as well as the worries related to the trade war.

Cramer further stated that because of the reneging the investors will presume that something is really very wrong and that the scenario is worse than what they have made of it.

According to Cramer that despite the decision of the Central bank of taking a more data dependent approach considering it more worthy even after the data of jobs being weak, the chair person has placed himself in a difficult situation because of the statements that he has made recently.

The host of Mad Money, stated that though it would be wrong to tighten at this time but if the chairperson fails to do so by not giving the public a rate hike of full quarter point then it will definitely cause panic.

In the beginning of the week, the “yield curve inversion” between the Treasury yields of three and five years also gave off warning alarms on the Wall Street thereby spurring an acute sell-off of the stocks.

Cramer also advised the public to get used to this as this is the new normal.

Source: CNBC