With the pandemic subsiding in 2022, many homebuyers were finally looking forward to buying their dream house. However, the increase in mortgage rates made it highly unaffordable for many. Will 2023 be a different story?

A tough year to buy a house

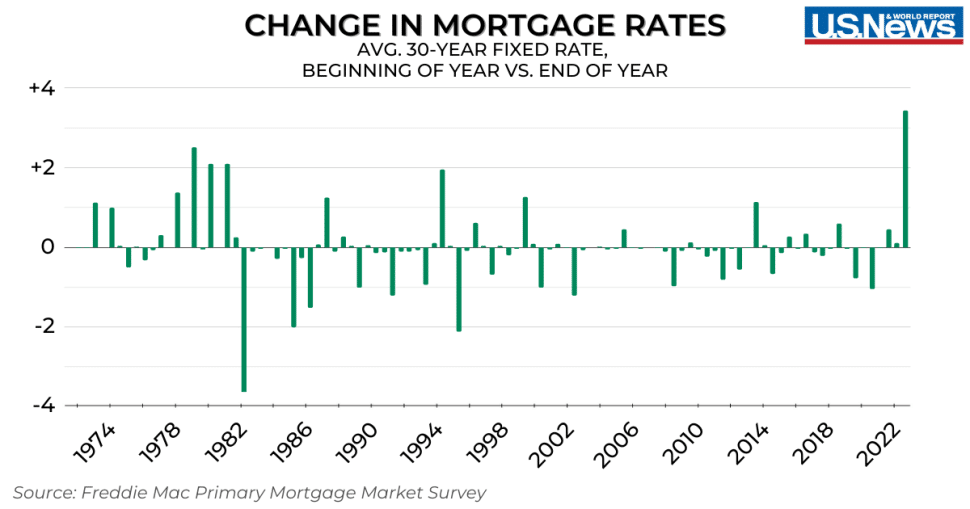

According to historical data from Freddie Mac’s Primary Mortgage Market Survey, the mortgage rate in 2022 rose higher than any other year. The average Mortgage rate in 2021 was 2.98% and surged to 7.08% in 2022. At the beginning of the year in January 2022, the average rate of a 30-year fixed mortgage was 3.22%. This increased by the end of the year and ended at 6.42%.

In the third quarter of 2022, 1.97 million mortgages secured by residential property (1 to 4 units) were generated in the United States. This data was according to the third-quarter 2022 U.S. Residential Property Mortgage Origination Report from ATTOM. ATTOM is a significant curator of real estate data nationwide.

This statistic was down 47 percent from the third quarter of 2021. This is the most significant annual reduction in 21 years, and down 19 percent from the second quarter of 2022, the sixth consecutive quarterly decline—a difficult time for many to buy a house.

Will 2023 be any easier?

According to the financial services website Bankrate forecast, the fixed interest rate of a 30-year mortgage in the U.S. is expected to drop by 2023. Fed officials are planning to continue rate hikes to reduce inflation. This will discourage investment and make it more expensive to borrow money. There is a potential that this can trigger a recession, because of which many may lose jobs.

Housing markets around the world pic.twitter.com/R6aFOS6gNP

— zerohedge (@zerohedge) December 30, 2022

This is positive because most mortgage interest rates will decrease during a recession. This rate drop could be good news for many homebuyers as it reduces house ownership costs.

Although the dip in rates will not be as low as pre-pandemic rates, the lack of houses in the market could still keep the prices high. This may lead many potential house owners to remain on the sidelines.