The Minnesota Timberwolves, a team synonymous with potential yet starved for sustained success, are witnessing a seismic shift in their ownership landscape. This change isn’t just about sports; it’s a fusion of financial acumen and strategic partnerships poised to reshape the future of the franchise.

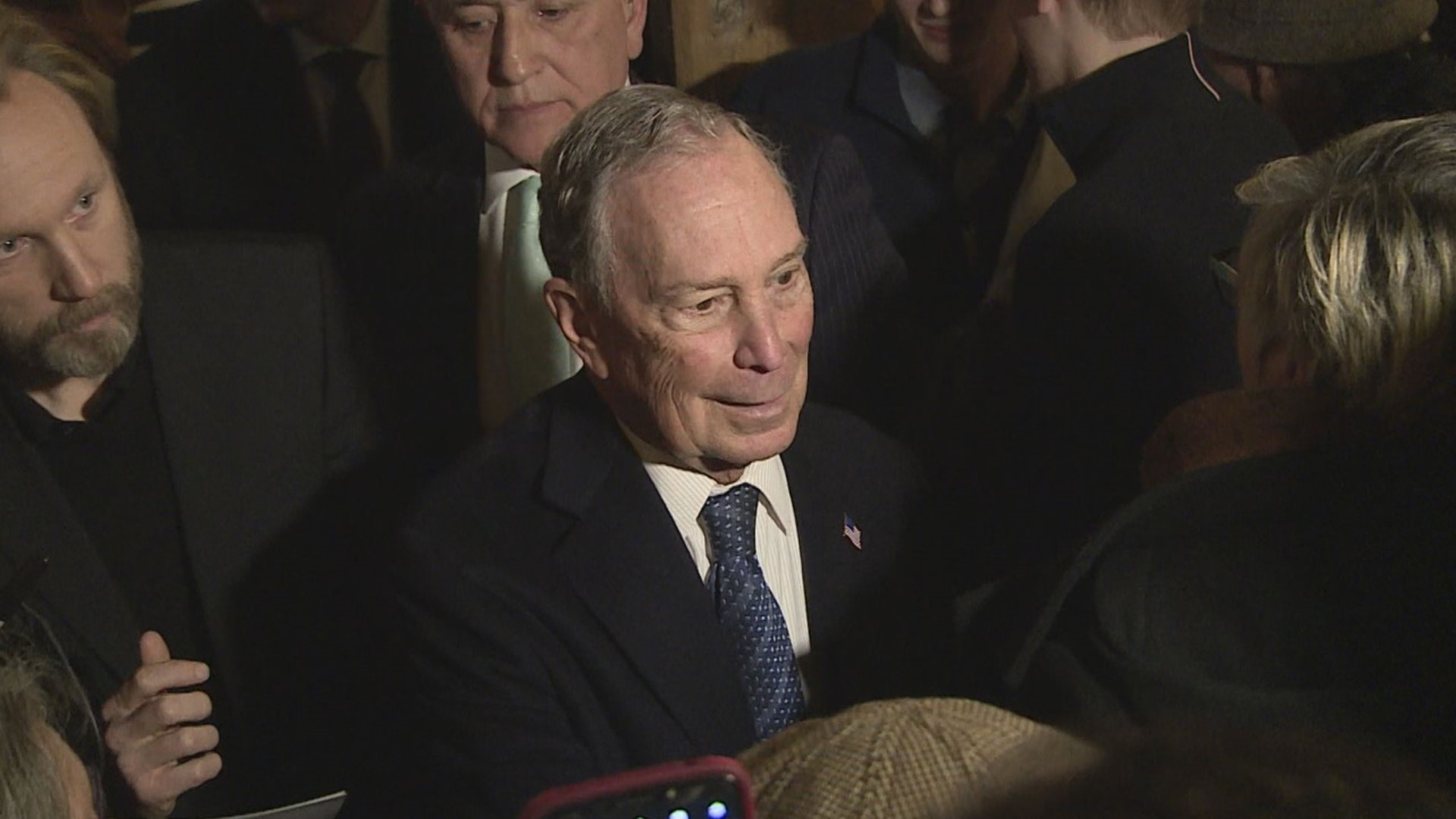

Michael Bloomberg: A Billionaire’s Entry into NBA Ownership

Billionaire businessman and former New York City mayor, Michael Bloomberg, has officially signed on to join the ownership group spearheaded by Marc Lore and Alex Rodriguez. This coalition is not just any gathering of investors but a power-packed assembly of minds and money aiming to take full control of the Minnesota Timberwolves and the WNBA’s Lynx.

Currently holding nearly 40 percent of the franchises, Lore and Rodriguez’s group is strategically navigating a path to majority ownership, a journey fraught with negotiations and legal hurdles.

Bloomberg, whose wealth is legendary, ranked as the 12th richest person in the world by Forbes as of April, adds not only financial weight but also a robust layer of credibility to the group. According to sources from The Athletic, Bloomberg’s involvement could accelerate the process, enabling a substantial final investment that might otherwise have been delayed until the end of the next season.

The Path to Majority Ownership

The journey to majority ownership has been a rollercoaster. Originally, Lore and Rodriguez struck a phased deal with current majority owner Glen Taylor for a $1.5 billion valuation, aiming to gradually take over. The duo purchased significant stakes in 2021 and 2023, reaching 36 percent equity.

However, their plan to secure an additional 40 percent this March was stymied when Taylor pulled out of the deal, citing financial instabilities and missed benchmarks by Lore and Rodriguez.

In a twist of strategy, Lore and Rodriguez switched their financing to Dyal Capital after a withdrawal by the Carlyle Group, only to face accusations of insufficient funds from Taylor. The dispute has since moved to arbitration, a process expected to consume much of the summer, but both Lore and Rodriguez remain confident, asserting that the funds for acquisition are ready.

Bloomberg’s Strategic Influence and Future Prospects

Adding Bloomberg to their ranks is seen as a masterstroke for Lore and Rodriguez. Not only does it provide the necessary capital to push through the final stages of their purchase plan, but it also adds a layer of financial security and business acumen that is hard to challenge.

If the arbitration and subsequent NBA board approvals go their way, this group could herald a new era for the Minnesota Timberwolves. Beyond the immediate financial implications, Bloomberg’s entry is a clear signal to the league and the fans that the Minnesota Timberwolves are not just aiming to stabilize but to compete at the highest levels.

The proposed plans, including paying the luxury tax and potentially building a new privately financed arena in Minneapolis, underscore a commitment to excellence and growth.

Minnesota Timberwolves on the Threshold of Transformation

With a star-studded lineup featuring Anthony Edwards, Karl-Anthony Towns, and Rudy Gobert, the Minnesota Timberwolves are already making waves on the court. The addition of deep-pocketed investors like Bloomberg could provide the financial muscle to sustain and build on this success.

This strategy extends beyond just buying the team; it involves creating a sustainable, profitable, and competitive franchise that can thrive in the competitive landscape of the NBA.

The scenario unfolding around the Minnesota Timberwolves is more than a business transaction. It is a narrative of ambition, strategy, and the relentless pursuit of success. As this new chapter in their history begins, all eyes will be on how these power moves off the court help in translating potential into real, lasting achievements on the basketball court.