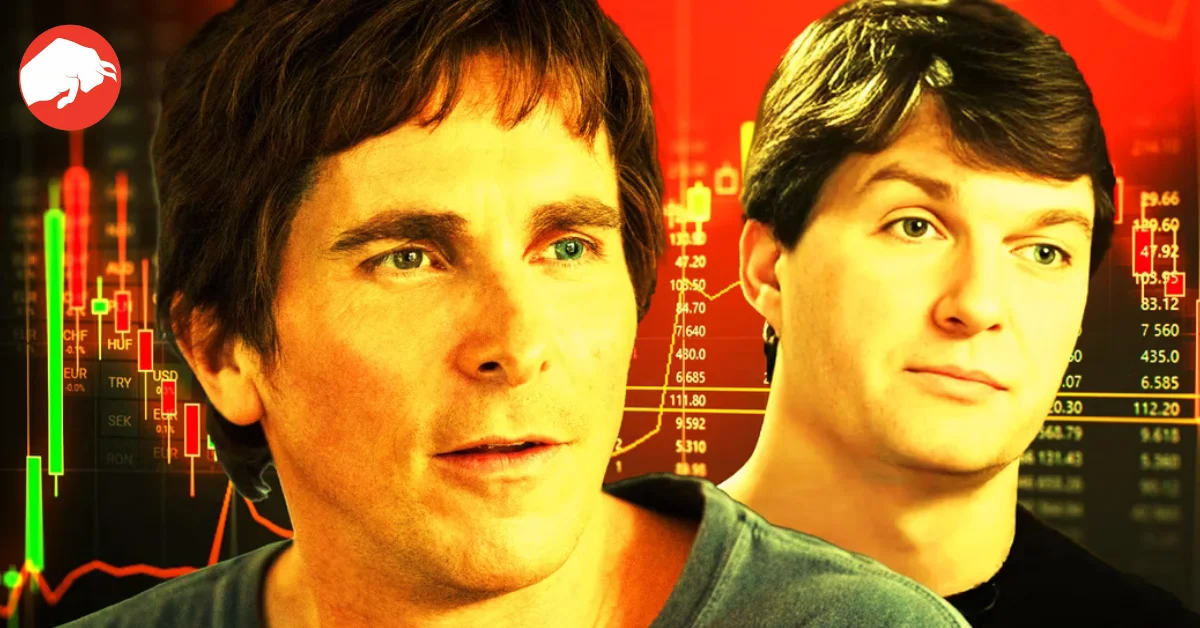

The Man Behind ‘The Big Short’: Michael Burry’s Role in the Financial Crisis

The name Michael Burry may not ring a bell for some, but those who’ve seen Adam McKay’s The Big Short would know him as the man brilliantly portrayed by Christian Bale. The film, a real-life tale of the tumultuous period leading to the 2007-2008 financial downturn, positioned Burry at its epicenter.

While the film unraveled the life stories of several individuals who profited from the economic decline and the subsequent housing market plunge, Burry’s journey was particularly striking. As the founder of Scion Capital, he possessed the foresight to see the impending doom in the housing market. Burry’s understanding of the precariousness of the market led him to short market-based mortgage-backed securities, a financial move that may sound complicated to most but, in essence, was designed to ensure he and his investors emerged from the financial crisis significantly richer.

However, this strategic move, while profitable, wasn’t without its consequences. Many frowned upon Burry’s tactics. And while the crash filled his coffers, it simultaneously tainted his legacy.

Scion Capital’s Closure and Michael Burry’s Brief Hiatus

As the dust settled post the housing market crash of 2007, 2008 saw Burry taking the decision to close Scion Capital. The decision wasn’t solely financial. Public backlash and audits from the IRS played their part. A notable tidbit from The Big Short reveals that despite his invaluable insights into the collapse, his attempts to share them with the government went unanswered. Instead, he faced multiple audits and even an FBI interrogation.

But Michael Burry, now a millionaire from his astute market predictions, didn’t remain dormant. He moved on from the spotlight and controversy, focusing on his own investment ventures and sharing his insights. His 2010 op-ed for The New York Times shed light on his predictions, offering a deep dive into the housing market crash’s fallout.

A Return to the Investment World: Scion Asset Management

Burry’s hiatus from hedge funds wasn’t a prolonged one. In 2013, he returned to the scene, resurrecting his fund, albeit with a new moniker, Scion Asset Management. Under this banner, Burry embarked on personal investments spanning diverse areas like water, farmland, and gold. His interest in water was briefly hinted at in The Big Short, emphasizing his unique investment perspectives.

Michael Burry in 2023: Betting on the Future

Fast forward to the present day, and Michael Burry’s influence in the investment world remains undiminished. Reports from CNN in 2023 indicated that Burry’s hedge fund, Scion Asset Management, took significant positions, signaling a potential bet on another US stock market crash. His history of accurate market predictions makes this a closely watched move.

While The Big Short portrayed Michael Burry as a significant benefactor from the housing market crash, it also hinted at the repercussions he faced. Yet, a decade and a half after closing Scion Capital, his footprint in the investment realm is unmistakable. And if his recent ventures prove accurate, the real-life protagonist of The Big Short stands to grow his fortune even further.