The NFL, a titan in the world of sports, stands at the precipice of a groundbreaking shift in its ownership model, traditionally dominated by individual or family-operated entities. This exclusive circle might soon welcome private equity firms, a move that could redefine the financial landscape of a league valued at a staggering $163 billion.

At the heart of this transformation is the NFL’s ongoing committee meeting, poised to potentially introduce private equity into the fold by as early as October.

Private Equity Boosts NFL Team Investments

Private equity firms are no strangers to the sports arena, having invested in various franchises across major leagues like the NBA since 2020. These firms aggregate capital from affluent investors to acquire assets with significant growth potential. For franchise owners, who collectively boast a net worth in the billions, the appeal of private equity offers a much-needed financial breather.

This strategic move could alleviate the pressure of injecting personal wealth into the teams, redirecting funds towards essential projects such as stadium renovations—a sector that has increasingly relied on public funding.

NFL Considers Private Equity Ownership

The introduction of private equity could see these firms becoming minority owners without voting rights or direct decision-making power. The specifics of this arrangement are slated to be thoroughly discussed and likely finalized at an owners’ convention in Nashville, Tennessee. According to ESPN, a special committee of owners has been diligently examining possible modifications to the league’s ownership rules over the past nine months.

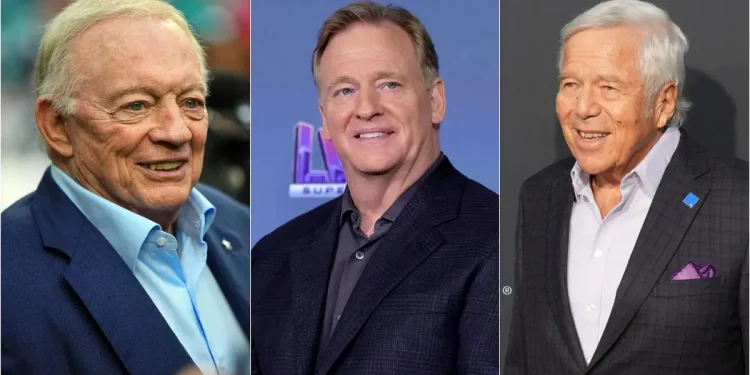

NFL Commissioner’s Insight on the Matter: “We’re making progress. I think there’ll be some changes, maybe as early as May, probably closer to October,” the NFL commissioner revealed to the press in March. This statement underscores the proactive approach the league is taking towards revising its ownership dynamics.

What’s in It for Private Equity?

The motive for private equity firms is clear: profitability. The NFL is not just America’s most beloved sport but also a veritable profit-making juggernaut.

“NFL teams are profit-making machines, and private equity would want to both share in the short-term year-to-year profits and also the long-term capital gain,” stated Brad Humphreys, a renowned sports economist. This perspective highlights the dual benefits that private equity firms aim to achieve by tapping into the lucrative market.

NFL Eyes Private Equity Transformation

Should the greenlight this shift, the impact could resonate well beyond the boardrooms and into the very essence of how the league operates and grows. By opening the doors to private equity, it could secure a more robust financial foundation, ensuring the sustainability of its franchises and potentially enhancing the fan experience with upgraded facilities and innovations.

This pivotal moment in history not only signals a potential shift in the economics of sports franchises but also sets a precedent for how other leagues might consider diversifying their ownership structures in the future. As stakeholders await the outcome of the Nashville summit, the anticipation builds on whether this move will mark a new era.