In an unprecedented move that has sent shockwaves through the sports industry, the Internal Revenue Service (IRS) has turned its focus towards the billionaire club of NFL owners, including prominent figures like Jerry Jones of the Dallas Cowboys and Stan Kroenke of the Los Angeles Rams. This scrutiny comes amidst allegations that these high-value individuals have been “paying very little taxes,” a claim that has sparked a nationwide debate on tax equity and the financial practices of sports magnates.

The IRS’s Game Plan Against NFL Owners

The revelation came to light through a leaked video, where IRS operative Alex Mena, who runs criminal operations for the agency, disclosed their strategy of closely monitoring NFL owners. Mena’s statement, “So, last week we decided to go after the owners of the NFL teams… All of them. So, that’s going to be fun,” has ignited conversations on the extent of tax obligations met by these wealthy team owners.

Bob Kraft, Jerry Jones, Stan Kroenke, Daniel Snyder, Shahid Khan, Woody Johnson & Bob McNair each gave $1M to Trump. https://t.co/QXSsiYu3X7

— Don Van Natta Jr. (@DVNJr) September 23, 2017

The aim, according to Mena, is to ascertain whether these billionaires are exploiting legal loopholes to minimize their tax liabilities. “Because they are like billionaires and they pay like very little taxes,” Mena explained, underlining the discrepancy between the owners’ enormous wealth and their relatively meager tax contributions. The IRS’s aggressive stance reflects a broader initiative to ensure that these high-profile individuals contribute their fair share to the public coffers.

The Billionaires’ Club: A Closer Look at the Targets

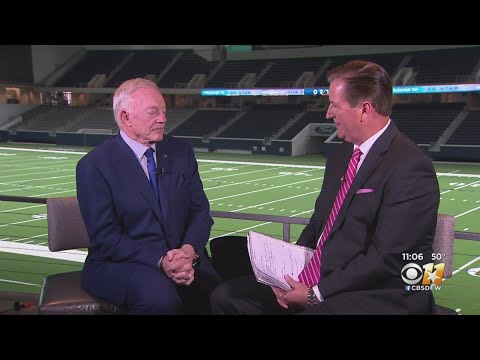

Among the notable names on the IRS’s list are Jerry Jones and Stan Kroenke, owners of the NFL’s top-valued franchises. The Dallas Cowboys, led by Jones, stand at the pinnacle of the league with a staggering valuation of $9.2 billion.

Close on their heels are the New York Giants and Kroenke’s Los Angeles Rams, valued at $7.04 billion and $6.94 billion, respectively. These figures not only highlight the immense financial clout of these teams but also the significant tax implications tied to their ownership.

The scrutiny extends to all NFL team owners, with Mena emphasizing, “All the teams, everyone. They don’t care, these people are not afraid of anything. If we find a mistake, we make them pay like $100 million. That’s a drop in the bucket for them. Each NFL team is worth $3 billion at least.

” This statement sheds light on the scale of the IRS’s operation and the potential financial repercussions for any discrepancies uncovered.

The Broader Impact: NFL Teams and Tax Compliance

This IRS operation marks a pivotal moment in the intersection of sports, finance, and governance. NFL teams celebrated not just for their athletic achievements but also as financial juggernauts now find themselves at the center of a critical discussion on fiscal responsibility and transparency. The outcomes of this scrutiny could herald a new era in how sports franchises are viewed in the realm of public finance and tax equity.

As the IRS continues its meticulous examination of NFL owners’ tax practices, the sports world watches with bated breath. The implications extend far beyond the individuals targeted, touching on issues of legal compliance, financial ethics, and the societal responsibilities of the ultra-wealthy. This unfolding saga serves as a reminder of the complex interplay between wealth, power, and accountability in the highest echelons of American sports and business.

In conclusion, the IRS’s focus on NFL owners for their tax practices underscores a significant shift towards greater accountability and transparency among America’s elite. As this story develops, it will undoubtedly raise important questions about the obligations of the wealthy and the role of governance in ensuring fair play, both on the field and in the financial arena.