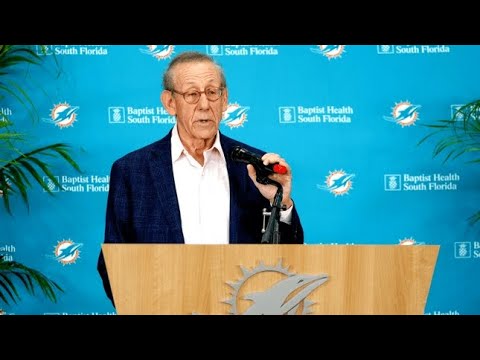

In an era where sports franchises are seen not just as teams but as significant business ventures, Stephen Ross, the owner of the Miami Dolphins, has made headlines by turning down a colossal $10 billion offer. The offer, presented by Ken Griffin, CEO of the global hedge fund Citadel LLC, included not just the NFL team but also the Hard Rock Stadium and the rights to the Formula One Miami Grand Prix. According to a report from USA Today, Ross, at 83, has chosen to keep these valuable assets within his family, signaling a focus on legacy over liquidity.

A Look into the Assets Involved

The Miami Dolphins alone hold an impressive valuation of $5.7 billion, ranking them 11th in the NFL, as per the latest figures from Forbes. This valuation speaks volumes about the franchise’s growth and the strategic management under Ross’s ownership since he acquired it in 2008 for $1.1 billion from Wayne Huizenga.

Moreover, the Miami Grand Prix, under a 15-year agreement with Formula 1, adds substantial value, with an estimated annual operating income of between $350 million to $500 million. This event alone highlights the foresight in Ross’s diverse investment portfolio within the sports and entertainment sectors.

Stephen Ross’s Investment and Vision

Ross’s journey with the Dolphins and associated assets has been marked by significant investments aimed at enhancing the fan experience and the economic footprint of his holdings. Over the years, he has not shied away from pouring funds into the team and its infrastructure. Notably, the Dolphins’ stadium underwent extensive renovations in 2015 and 2016 to accommodate large-scale events like the Super Bowl and potentially, the World Cup. In 2021, a $135 million investment was made into a state-of-the-art training facility, further signifying Ross’s commitment to building a robust sporting franchise that extends beyond the gridiron.

Kenny Griffin is turned down!!!!! Thank you Stephen Ross for saving my beloved Dolphins from this criminal!!!! pic.twitter.com/NP78FQqNa3

— DJ (@DJArtistone) May 2, 2024

A Future Rooted in Family and Legacy

Ross’s decision to reject the $10 billion offer might seem astounding to many, especially considering the potential immediate financial gains. However, his intent to keep the Dolphins “in the family” suggests a strategy focused on long-term influence and stewardship in the sporting world. This move could potentially set a precedent in how owners view the custodianship of their sports franchises—not merely as assets to be traded but as legacies to be nurtured and passed down through generations.

In an age where the commercial aspects often overshadow the cultural and emotional connections of sports teams, Ross’s stance is both refreshing and commendable. It reflects a deeper understanding of the role of sports teams as integral parts of communities and personal legacies, ensuring the Dolphins remain more than just a line item on a balance sheet.

Conclusion

As the sports world watches on, Stephen Ross’s decision could mark a seminal moment in sports franchise ownership. It underscores the profound personal and familial bonds that can shape the decisions of those at the helm of major sports entities. While the business implications are indeed significant, the emotional and legacy considerations appear to have tipped the scales in this instance, pointing to a future where such entities may increasingly be viewed through the lens of heritage and legacy over mere monetary value.