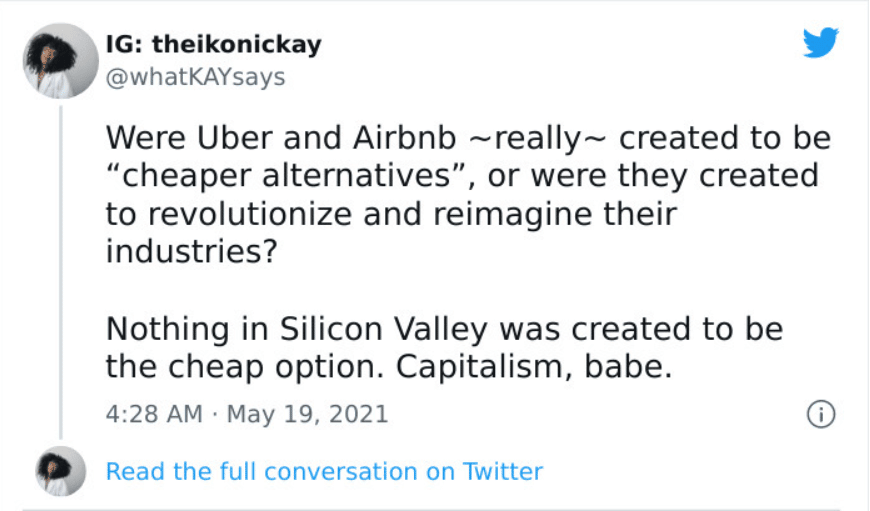

A few years ago, people enjoyed their stay at Airbnb. This company always advertised itself as connecting guests with unique local hosts and experiences.

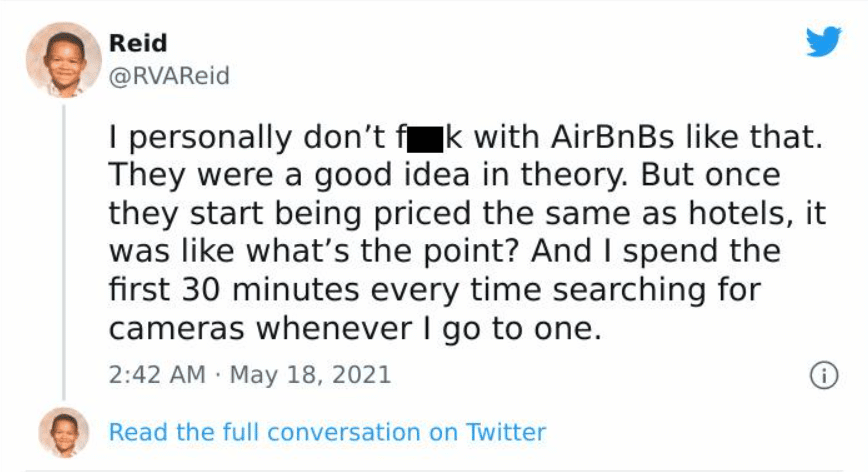

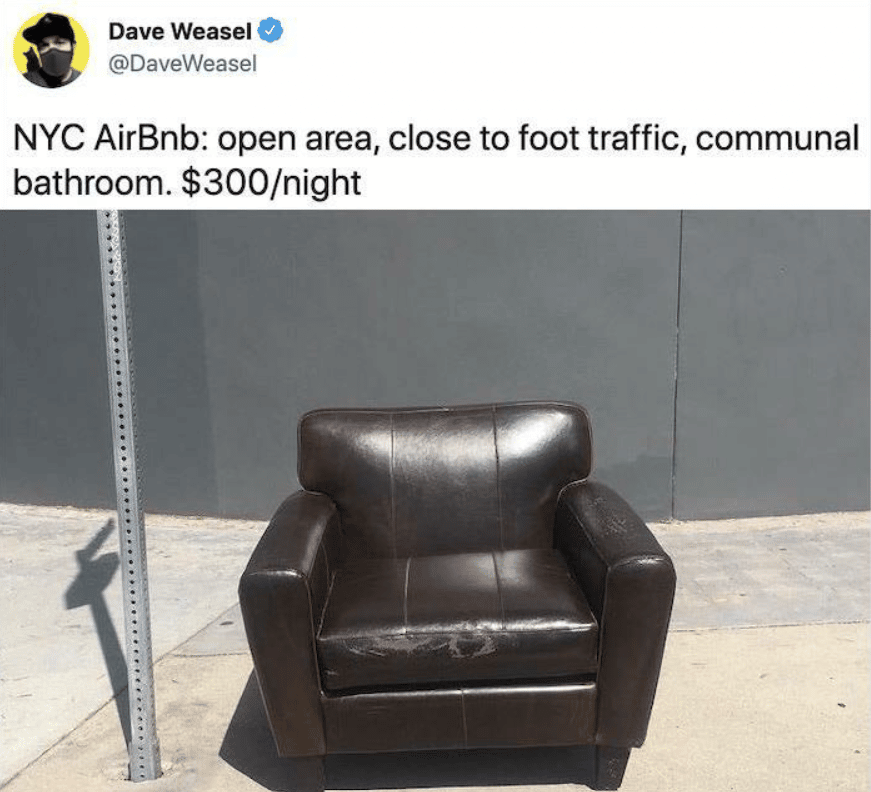

But now, more and more people are beginning to think that Airbnb is bad. That’s because as Airbnb has grown, it has wrestled with more instances of scams and low-quality listings.

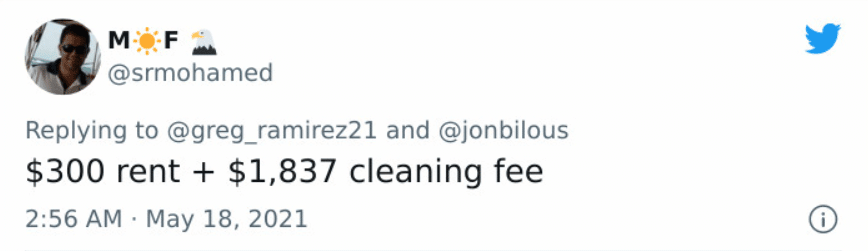

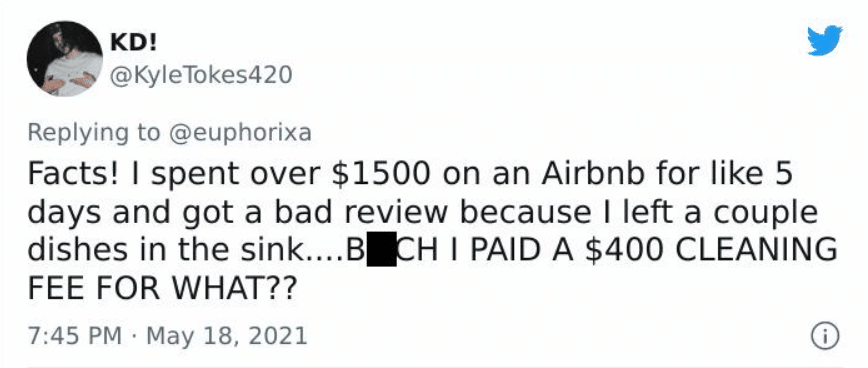

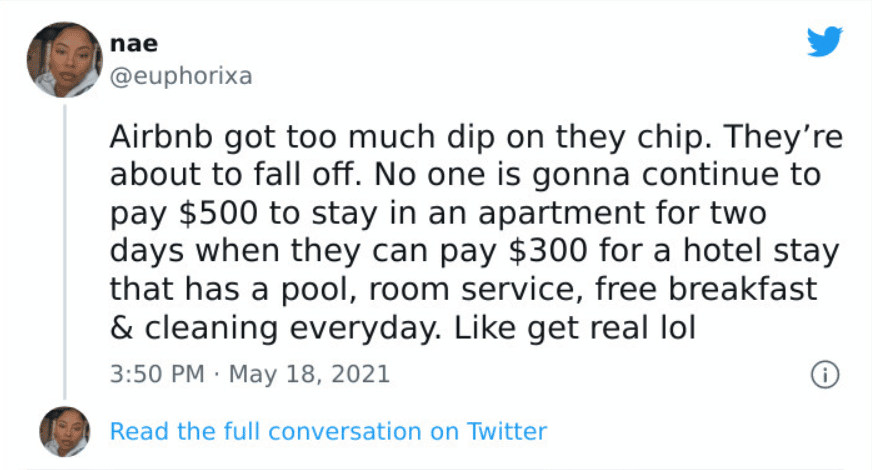

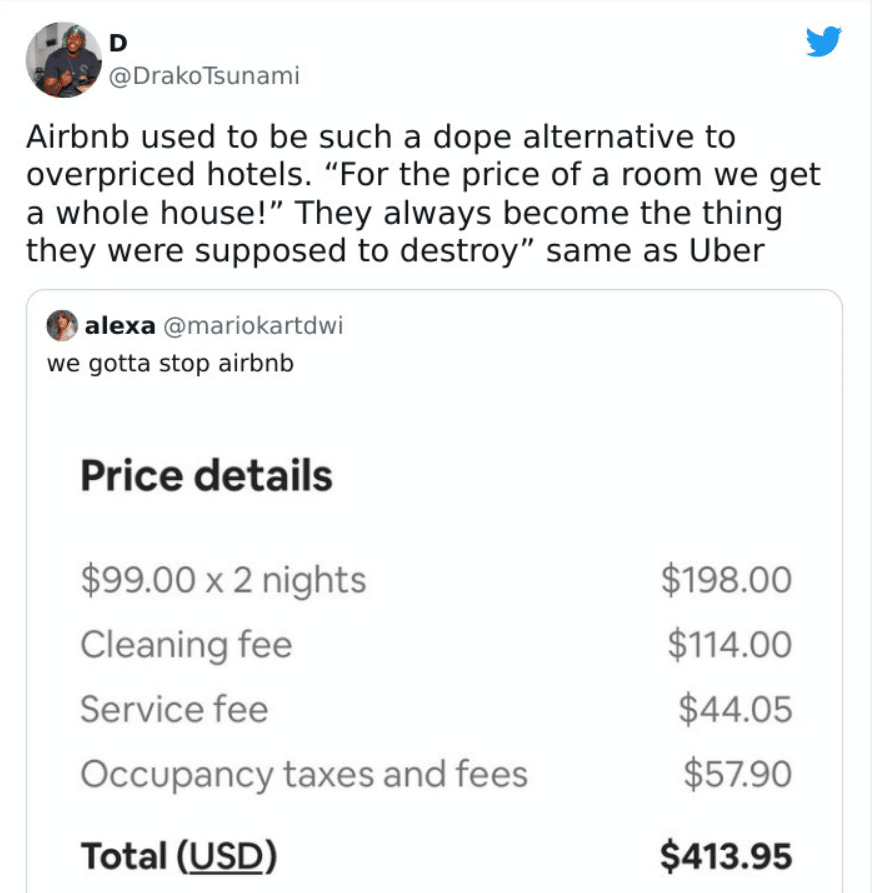

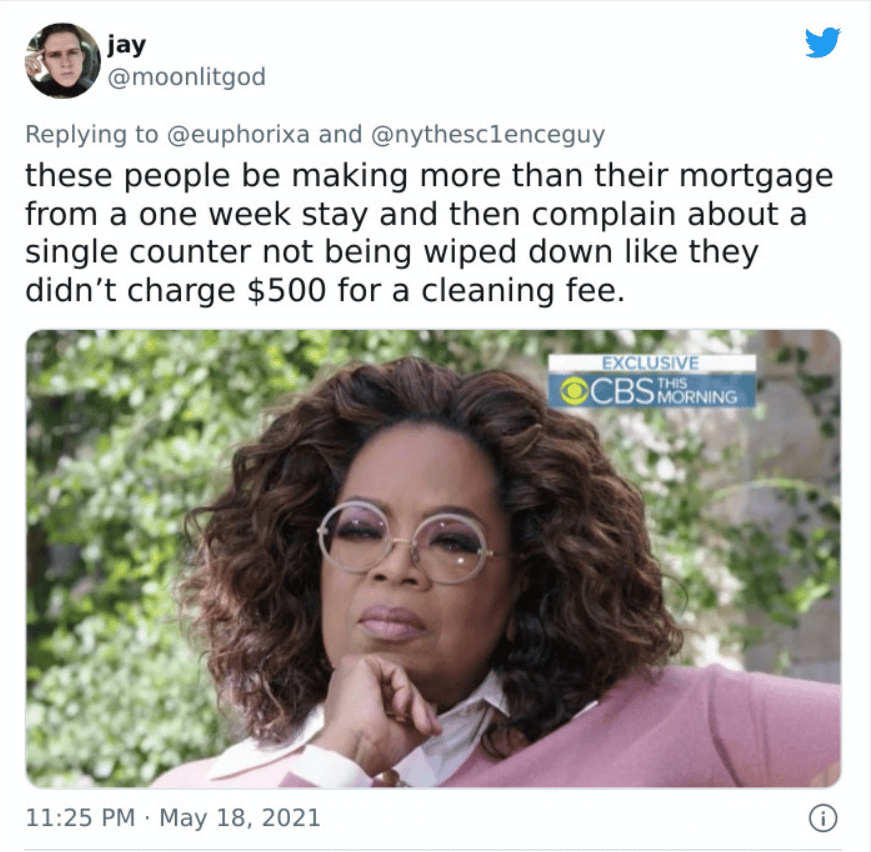

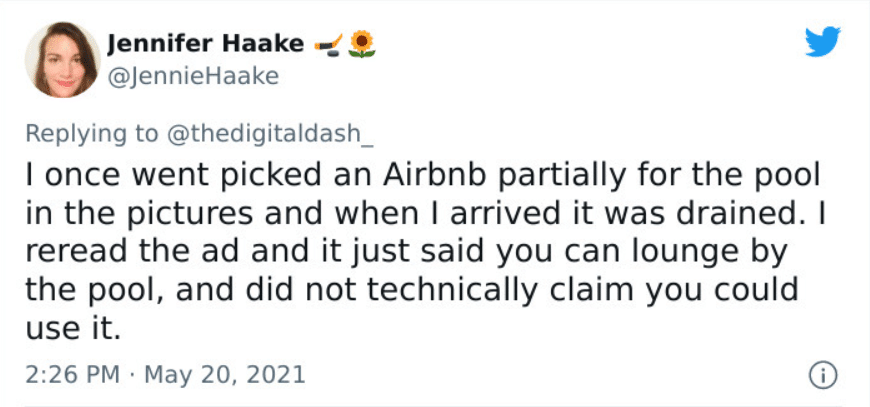

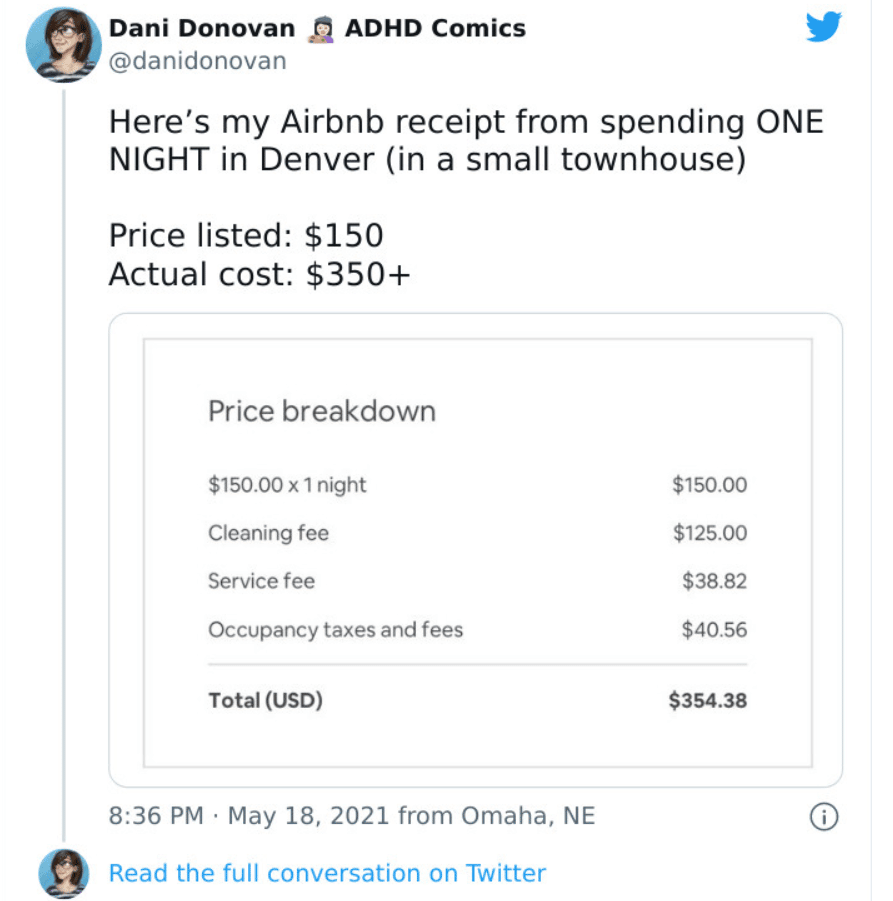

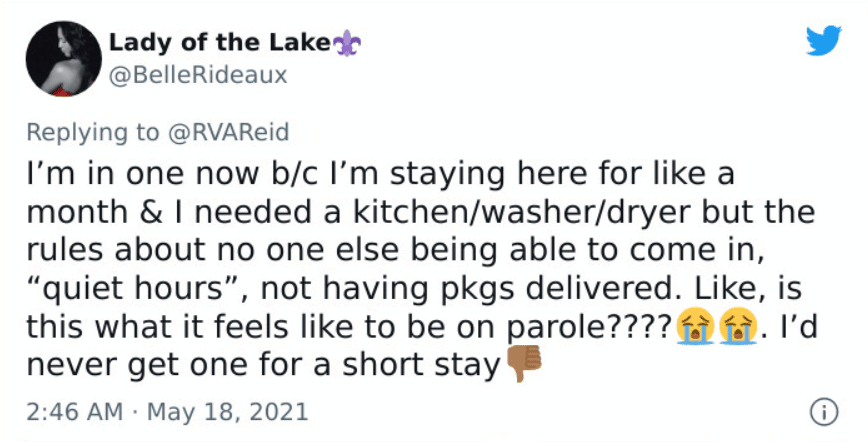

Also, there are the extensive cleaning fees and house rules which can pile up really quickly—the company has a hard time striking the right balance between allowing hosts to express their individuality and ensuring a consistent and high-quality experience for guests.

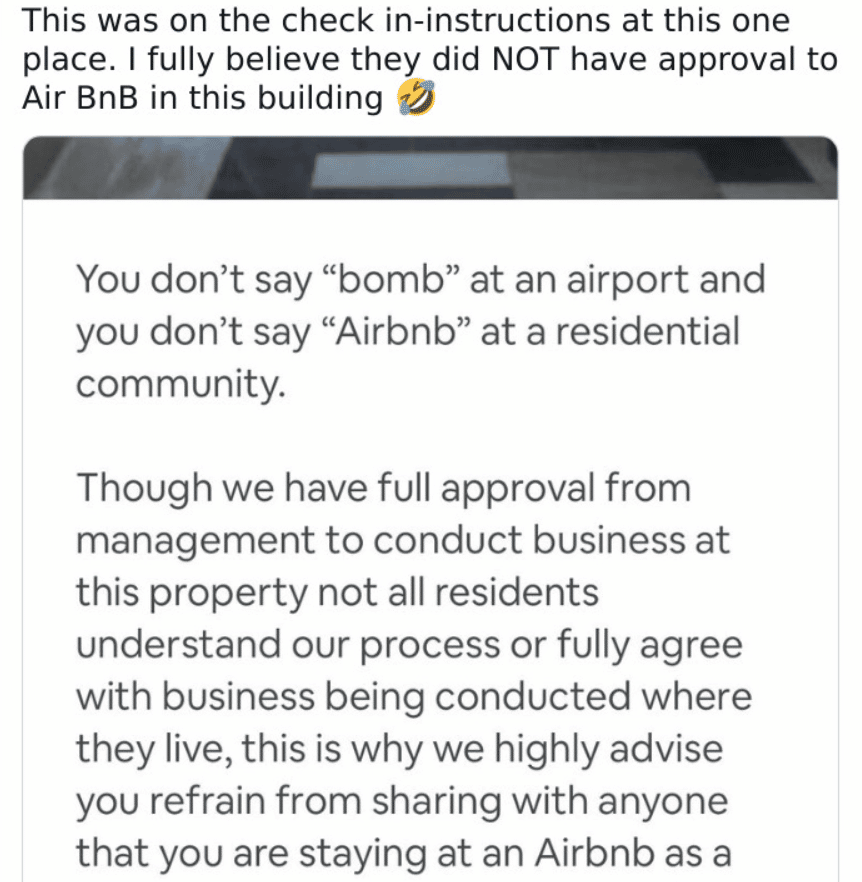

Of course, it’s quite often that the middlemen are often hated by their clients but Airbnb is taking heat from even outside their user base. For example, if your neighbor is renting their property through the platform, you might get sick and tired of the home next door constantly throwing loud parties.

And that’s just scratching the surface. Airbnb has also been exploiting legal loopholes that allowed it to pay way less in taxes than hotels. The list goes on.

So to recap all the reasons why folks dislike it, we collected their complaints (and a few jokes) from Twitter and are putting them on display for everyone to see.

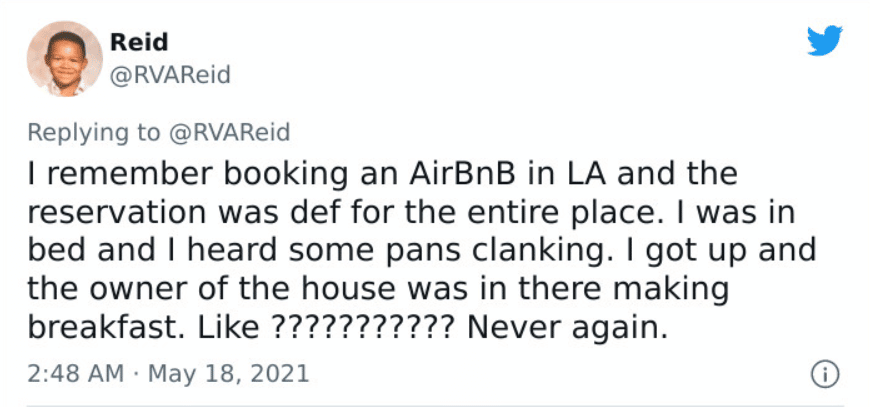

1.

Travel blogger and speaker A Lady in London, who has been to 112 countries, fire up the app from time to time.

“I use Airbnb on occasion when I travel,” she told us. “I’ve generally had a positive experience with its services, but every property and stay varies.”

However, she said a hotel is a better choice when you want to know exactly what you’re getting. “Hotels are more consistent with what they offer in terms of amenities and services, whereas Airbnbs can vary widely. Hotels are also better if you need to store your bags after you’ve checked out, as many Airbnbs don’t offer that service,” A Lady in London explained.

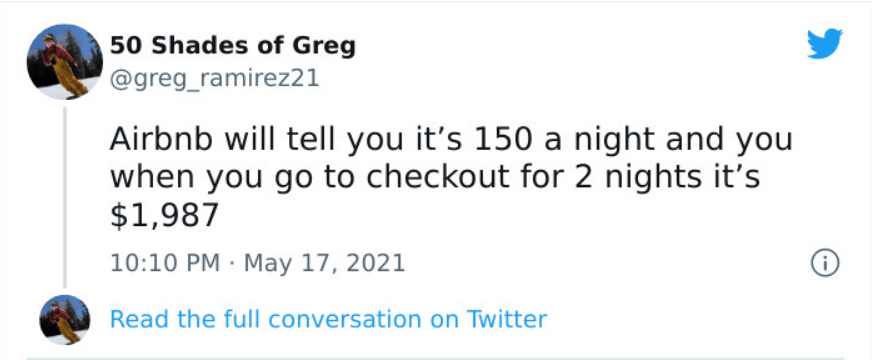

2.

For years, Airbnb had been battling local officials over requests to collect occupancy taxes and ensure that the properties listed on its site comply with zoning and safety rules.

Consider this: in a five-month span between 2018 and 2019, the company spent more than half a million dollars to overturn regulations in San Diego and has sued Boston, Miami, and Palm Beach County over local ordinances that require Airbnb to collect taxes or remove illegal listings.

Elsewhere, Airbnb had fought city officials over regulations aimed at preventing homes from being transformed into de facto hotels and requests from tax authorities for more specific data about hosts and visits.

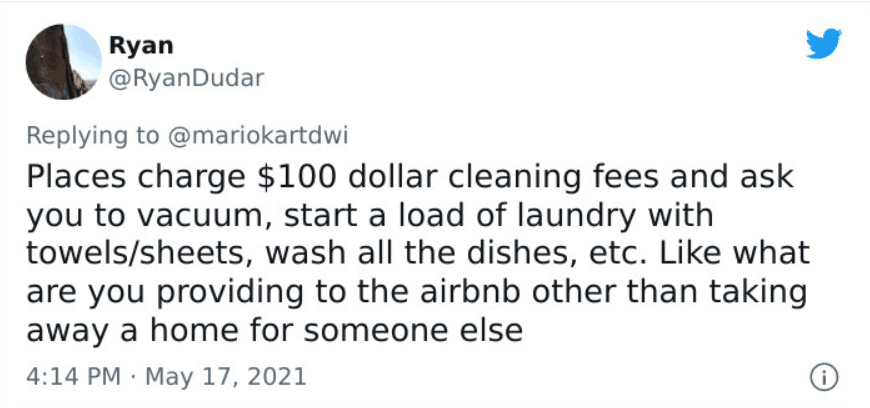

3.

4.

5.

Suspecting that Airbnb may have been shorting states and local governments billions of dollars in taxes, lawmakers eventually began to push legislation to take control of the process.

While the proposals vary, many states in the US, for example, aim to close what they saw as a yawning tax gap caused by reliance on hundreds of industry-driven voluntary compliance agreements (VCAs) with local governments.

Some local jurisdictions speculate Airbnb and other similar platforms are banking only a quarter of the occupancy taxes owed. The revenue implications are only getting larger as the U.S. short-term rental industry continues to expand.

6.

7.

8.

“The short-term rental industry is a large business worth more than $30 billion a year. The average lodging tax rate is in the 8% range across the country. So there should be total collections in the billions of dollars, but I don’t think that’s actually happening,” Ulrik Binzer, chief executive officer of Host Compliance LLC, which provides lodging-tax compliance services to more than 300 municipalities across the U.S. and Canada.

Binzer said that Host Compliance took on Nashville, Tennessee, as a client after the city declined to negotiate an agreement with Airbnb. At the time, annual occupancy tax collections hovered around $1 million. But after implementing a series of short-term rental compliance and enforcement strategies, Nashville boosted its collections to $9 million annually.

As regulators have sought to crack down, Airbnb has entered into “voluntary” agreements with many local governments, promising to collect taxes on behalf of hosts, which is one of the reasons why customers may have seen higher taxes on more listings.

9.

10.

11.

12.

Airbnb’s increasing popularity has attracted hordes of corporate real-estate owners and professional property managers to its platform, many of whom own or operate dozens of listings within the same city.

According to the analytics site AirDNA, just 5% of hosts own or operate nearly a third of all Airbnb listings, reflecting the massive power wielded by corporate and professional hosts.

This has most likely been driving up rent and housing prices in neighborhoods with Airbnb listings, according to research from recent years.

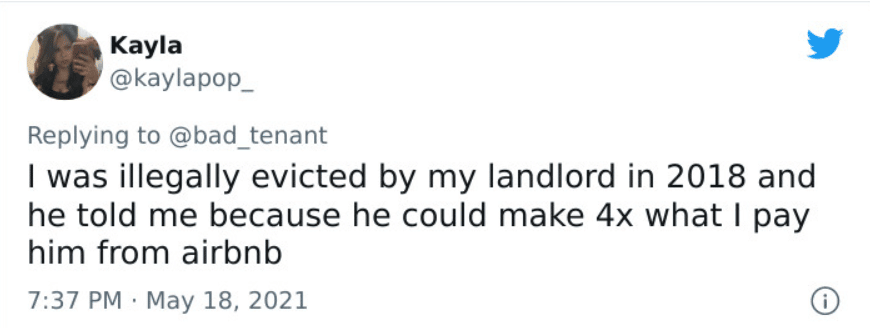

13.

14.

15.

16.

More places listed as short-term rentals also mean fewer long-term options. Felix Meindl and Dr. Oliver Arentz, researchers at the University of Cologne in Germany, reported that short-term rentals via apps such as Airbnb contribute to housing shortages and rent increases.

Their econometric regression analysis shows that 14.2% of overall rent increases for the affected apartments within the study period (in the city of Cologne) can be attributed to short-term rentals. This results in a rent increase of around €27 ($27.7) per month or €320 ($351.9) per year for new tenants.

17.

18.

19.

20.

“While a large proportion of hosts can be considered home sharers, we find an increasing proportion of providers who have developed a professional business model from short-term rentals,” Meindl said in a statement. “Professional short-term rentals are available to tourists throughout the year, and thus compete directly with long-term tenants, for whom the rooms are then no longer available.”

21.

22.

23.

24.

However, Airbnb isn’t all bad. Earlier this month, the company said it will help shelter some of the 2 million Ukrainians who have fled their country after Russia invaded it.

According to a company spokesperson, Airbnb is prepared to offer housing of up to 14 days for up to 100,000 refugees.

The organization works with nonprofits on the ground to book and coordinate stays for refugees, who also receive a range of other support in their new lives, the spokesperson explained.

25.

26.

27.

28.

29.

Plus, it’s a really good place to work at. In Glassdoor’s well-regarded ranking of the best workplaces in 2016, based on anonymous employee reviews, Airbnb was rated number 1.

And while ratings and rankings are up for discussion, the workplace and culture at Airbnb experts think the company can be used as a case study to provide instruction for other companies and HR managers. But does this negate all the things we talked about before?

30.