The share trading system was open for a large portion of Monday, and that was all that anyone could need time for the Dow Jones Industrial Average to drop 2.9 percent to 21,792.20, breaking 1918’s record for the most exceedingly bad Christmas Eve execution.

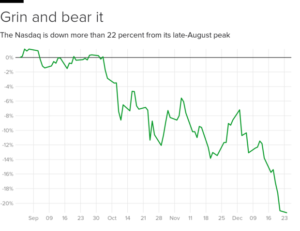

U.S. stocks are on track for their most noticeably awful year since 2008, which was amid the Great Recession, and their most noticeably bad December since 1931, which was amid the Great Depression.

The business sectors have been managing worries of a moderating worldwide economy, the exchange question with China and a week ago’s loan cost increment — the fourth by the Federal Reserve this year.

Endeavors by Treasury Secretary Steve Mnuchin on Sunday to console financial specialists exploded backward. He tweeted that he had talked with the leaders of the country’s six biggest banks and was guaranteed that they had adequate loaning limit.

“We’ve experienced circumstances previously where it’s completely typical for the secretary of Treasury to contact the private segment,” Quincy Krosby, a main market strategist at Prudential Financial, disclosed to The Wall Street Journal.

“In any case, what’s awful is this made the papers, and says the legislature is exceptionally stressed,” Krosby told the paper, including that with financial specialists concentrated such a large number of issues, “it’s as though gravity is pulling this market toward a lower level before it bottoms out.”

“The main issue our economy is facing is all because of Fed,” the president tweeted. “They are not having a vibe trading in market, they never comprehend essential Trade Wars or Strong Dollars or even Democrat Shutdowns over Borders.

Markets in Europe, Hong Kong, Australia and South Korea were shut for Christmas.

Source: NPR and Daily Mail