Tesla Cybertruck prices may soon decline due to the fall in Lithium prices. Some of the largest lithium refineries that produce battery-grade Lithium worldwide have ceased operations in the expectation that prices will rise.

The cost of a ton of lithium carbonate has been reduced every day this year, which should lead to cheaper EV batteries. To reduce the rate at which the price of lithium carbonate for batteries is dropping, major refineries in what is known as the “lithium capital of Asia” have halted output. In the Jiangxi region of China, two out of every four significant producers reportedly no longer use their equipment. The largest hub is Yichun, where lithium carbonate is produced for renowned Chinese battery producers like CATL or BYD.

Lithium prices are a key factor in determining Tesla Cybertruck price

The battery is usually the most expensive part of an electric car, and Tesla recently announced that the “SUVs & Trucks, Large Sedans” category, which the Cybertruck belongs to, will feature a typical 100 kWh battery size.

According to a recent statement from NIO, the cost of lithium carbonate declined by RMB 100,000 (US$14,500), resulting in a huge 2 percentage point increase in gross margin. It is hoped that some of the decreases in battery material prices would be passed on to Tesla’s customers, even those on the 1.8 mil-person Cybertruck waiting list, given that the company presently has a record-high profit margin.

The trend of decreasing Lithium prices impacted the Tesla Cybertruck price

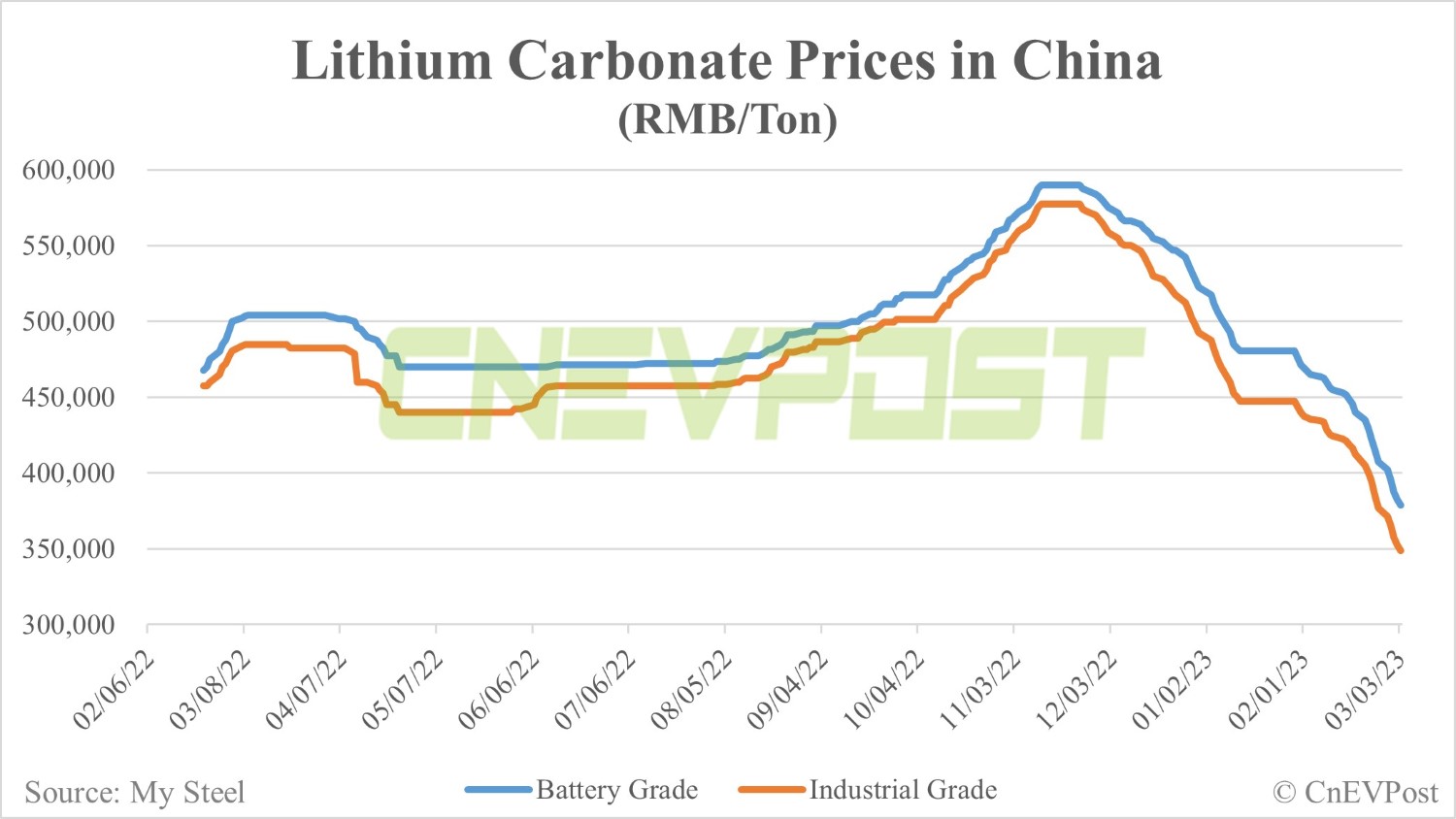

Lithium prices have dropped significantly this year due to weakening demand and growing supply, from a peak of US$85,691 per tonne of lithium carbonate in November to the present US$32,535 for EV batteries. Instead of the original prediction that the cost limit would be about US$30,000, analysts now think it may further drop to US$14,500 per tonne.

THE NEW TESLA CYBERTRUCK DESIGN SPOTTED FROM THE ABOVE.⚡ pic.twitter.com/MuyNJaw8uV

— TESLA CARS ONLY FAMILY⚡ (@teslacarsonly) April 20, 2023

This 83% drop from the top may cause the construction of a proposed lithium refinery to be temporarily cancelled. During the panic over lithium prices in the autumn, Elon Musk encouraged investment in refineries to obtain a “license to print money,” Tesla even considered building its refinery on the Gulf Coast.