Amid the sad news of the sales of many new treatments failing to match the expectations of the Wall Street, Trulicity, the diabetes drug by Eli Lilly and Company performed better than the expectations of the Wall Street, in its third quarter for the current fiscal year.

The better performance than what was expected by the experts and analysts has surely encouraging but the main factor for the better performance was lowered taxes and expenses. The sales if the drug was also affected by the low revenue from the new drugs.

Joshua Smiley the Chief Financial Officer told the analysts that the company is expecting sales in 2019 to suffer damage due to the loss of patent protection on the drug Cialis. He further added that he despite the loss he expects the new products of the company to compensate more than the losses.

He also said that Lilly is considering more acquisitions similar to one it acquired recently which was a $1.6 million purchase of Armo Biosciences, a cancer drug developer.

The company increased its adjusted earnings forecast from $5.40 to $5.50 per share for 2018 to $5.55 and $5.60 per share.

The company is currently depending upon the 10 new drugs which it had launched in since 2014 for growth and profit because the older treatments are facing increasing competition.

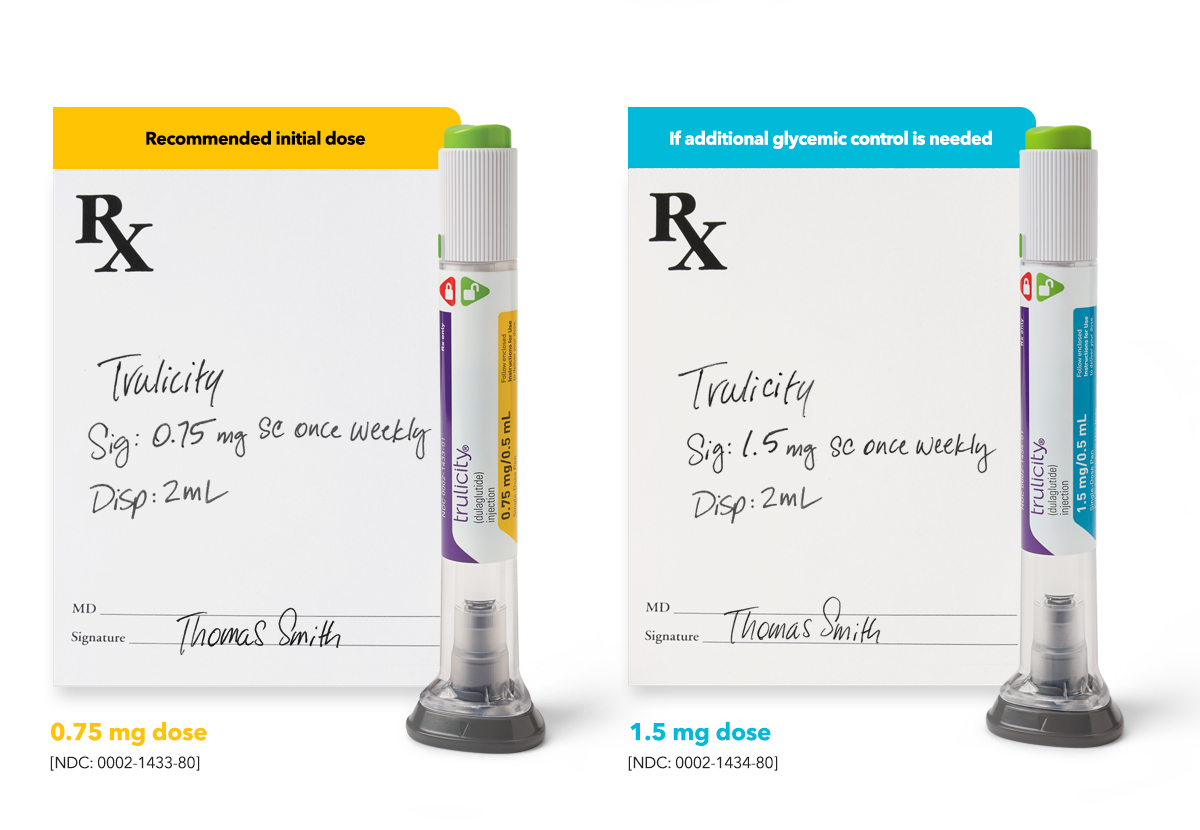

In an announcement made on Monday, the company stated that the drug Trulicity had reduced the risk of an heart attack significantly, affecting mainly to patients with type 2 diabetes as was deduced in a large trial held clinically.

The analysts said that the results from the trial must strengthen the position of Lilly as a leader in the care of diabetes.

According to the IBES data from Refinitiv, Lilly has earned $1.39 excluding its one-time items, and thereby topping the average estimate by 4 cents.

Source: Reuters, Trulicity