The housing market of Canada has cooled down and now the economists state that the once booming cities of the country now look unperturbed for the corrections which are uneven.

The housing market of Canada has cooled when the novel regulations of mortgage that aimed at reining in the demand in market along with risky lending which took great efforts at the beginning of the year.

The national sales if the beginning of the year had declined by 3.7 percent when compared to the October of the previous year.

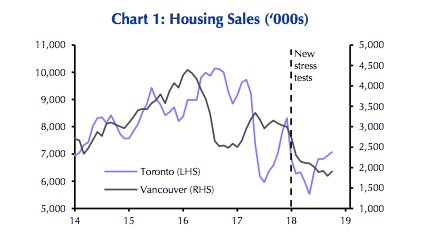

In the wake of the legislation, apparently Toronto has stabilized and now on uninsured mortgages, Toronto requires stress tests. However other cities are not heading towards the same soft landing.

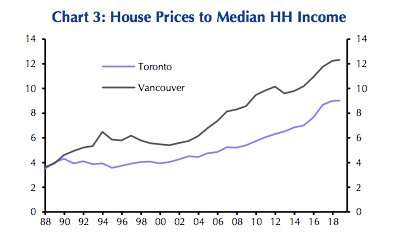

The housing market of Vancouver is more overvalued than that of Toronto. Stephen Brown, who is the Capital Economics Senior of Canada that the housing of Vancouver is heading for a bumpy landing.

There are high chances that the excess supply often referred to over-supply than demand, would be coming in the coming few years because of the escalation of the home listings of Vancouver to a four year high in this fall.

The regional estate board of Toronto stated this month that when compared to the last year, the sales this month increased by 6 percent whereas the average selling price had also witnessed an increase by 3.5 percent during that same period.

However the sales in Vancouver for the month of October were below the historic averages.

The Central Bank of Canada has increased the rate of interest almost five times since the summer of last year and the bank has been keeping a close watch on the housing market.

The senior deputy governor, Carolyn Wilkins stated on Thursday that risks are increasing even when the borrowing costs are increasing.

Source: BusinessInsider, TimesUnion