Apple has always managed to stay at the top in the Market, due to its amazing quality, reliability and unique Innovative Products. Every time, we feel like Apple is going to lose the race, it comes up with a new Invention and this time it had entered the banking field with the new Apple Card.

[fvplayer id=”859″]

Yes, you heard it right, Apple is soon going to launch a line of Apple Credit Cards similar to other bank credit cards with some extra features. Here is everything you need to know about the new Apple Credit Card.

What is the Apple Credit Card?

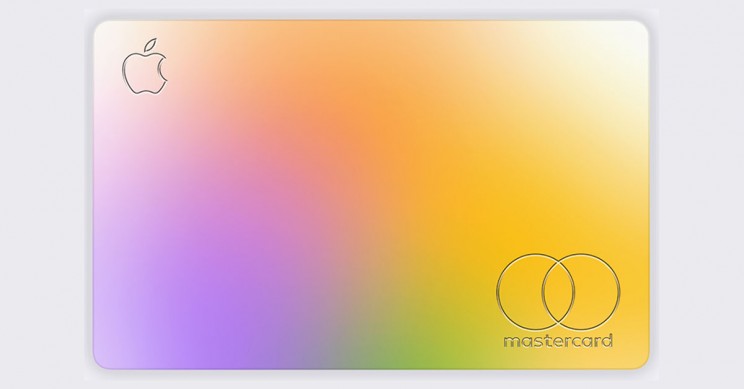

The Cupertino based Tech Giant Apple released the Apple Card this March, in a bid to conquer the financial domain market. Apple Card comes up in both a physical form and a digital in-built App in Apple iPhones. After the success of Apple Pay, the company was planning for an actual card with which payment can be made at a Universal Platform.

Apple’s physical credit card comes in a titanium design, with no CVV, code or any kind of Expiration Date. Apple is saying that it is more secure than any of the other physical credit cards. While the virtual card will be active in minutes, the Physical Card will be shipped to you in a few days with an option of customized usernames.

Apple Card: New Features

- The new Apple Card will be connected to the Wallet App in your iPhone and can be accessed from anywhere in the world.

- Apple Card will use the new machine learning technology to identify merchants and ensure smoother transactions.

- Apple Card Customers will get daily 2 to 3 percentage of cashback for payments made via the card.

- There are no overhead costs or any annual fees, also no late payment penalty and low interest rates in Apple Card.

- Apple’s Card has been MasterCard and Goldman Sachs for the flow of payment processing and credit score calculations.

How to get the new Apple Card?

As of right now, you can Apply for an Apple Credit Card on Apple’s official Website or through official Apple Stores. Apple has not announced any exact criteria or minimum credit score, but reports suggest that a credit score of 24.24 percent will be enough for you.

The true benefits of Apple Card will be only known when it arrives in the Market, till then you can only apply and wait for it if you are lucky enough, we Apple might select you for its Apple Card program. Stay tuned to Hiptoro for more Apple Card updates and other news.