Between 1995 and 2016 Sweden’s GDP per capita increased by 50 percent. According to the World Happiness Report 2020, it is the 7th happiest place on Earth. It is safe to say that the Swedes have it good. What is their secret?

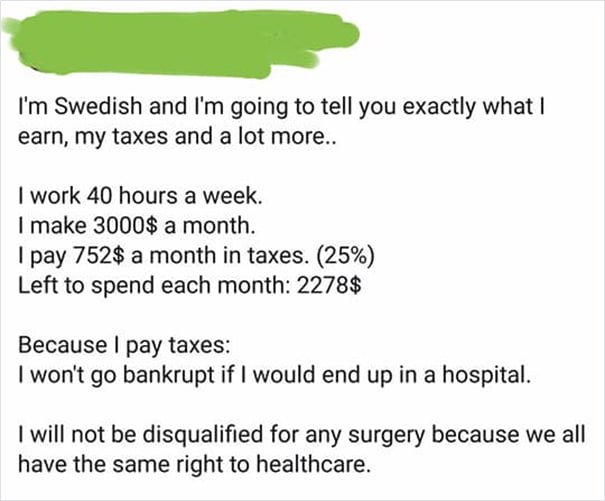

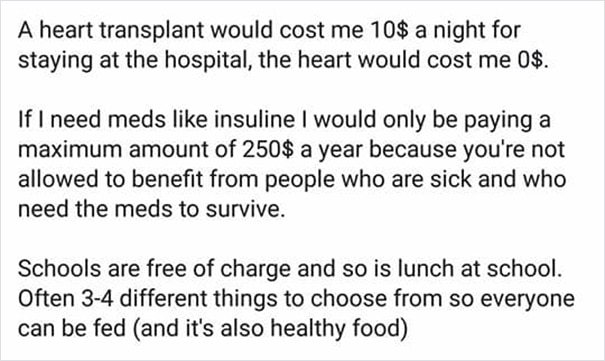

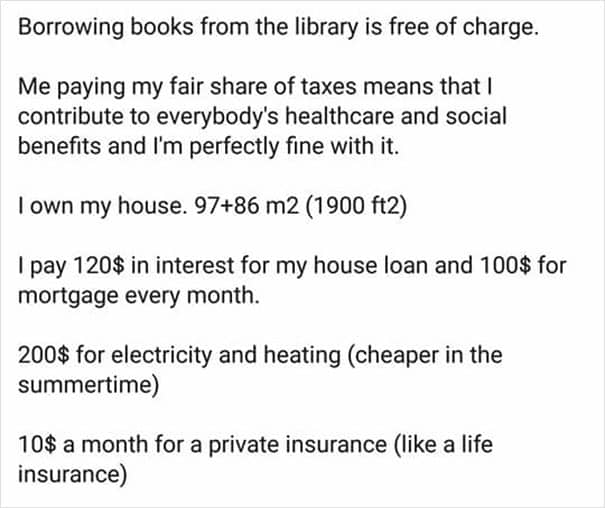

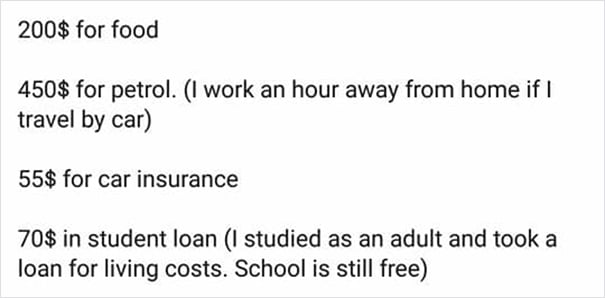

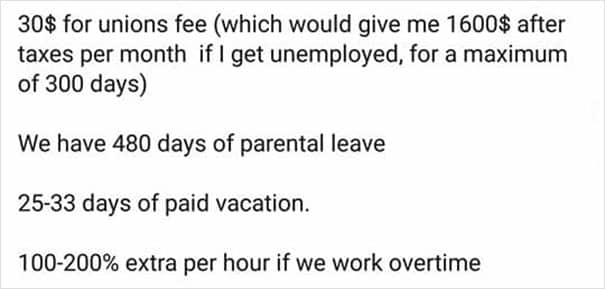

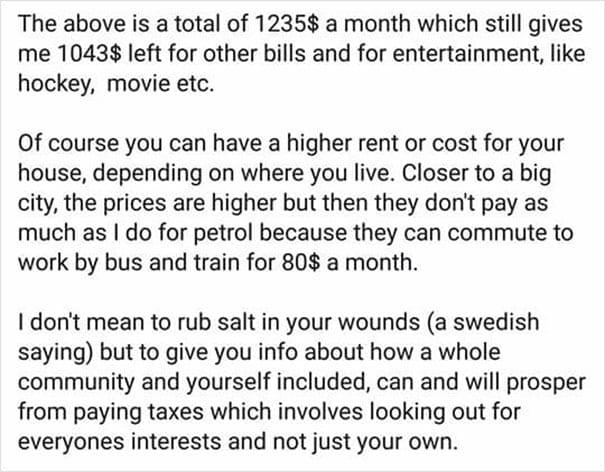

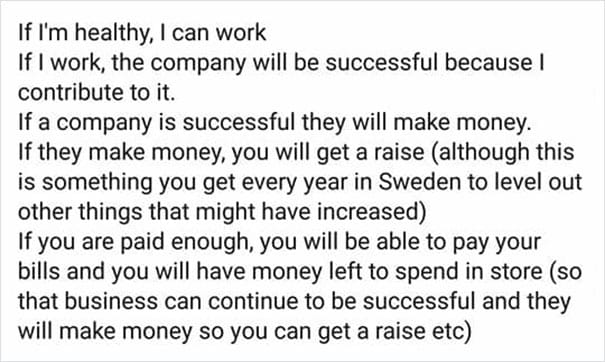

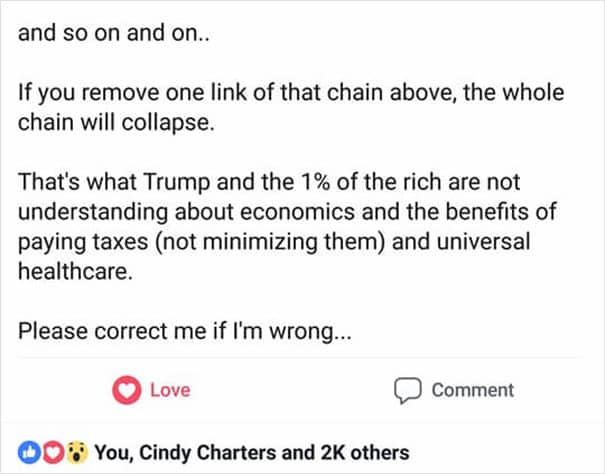

The Swedish citizen thinks it is internal politics. They used their own life as an example to explain taxes, healthcare, and other vital parts of their country. The post made its way into personal feeds abroad. Foreigners got jealous. Americans in particular.

The Tax Foundation’s Center for Global Tax Policy pointed out that the public funding of services such as universal healthcare, higher education, parental leave, and child and elderly care is well-known in the Nordic countries.

High levels of public spending require high levels of taxation. The tax-to-GDP ratio was 44.9%. In the US, the same was 24.3%.

The three Northern European countries raised a high amount of tax revenue as a percent of GDP from individual taxes, almost exclusively through personal income taxes and social security contributions. This was back in 2018.

The tax wedge is a figure that shows the difference between an employer’s cost of an employee and the employee’s net disposable income.

The tax wedge for a single worker with no children earning a nation’s average wage was over 40 percent in three countries (35.8% in Denmark, 35.9% in Norway, and 43% in Sweden). Tax wedges of Sweden and Norway are higher than those of the US. The tax wedge was 29.6%.

Sweden is a prosperous country that distributes wealth evenly. The sociopolitical model consists of three pillars. There is an economic policy that promotes openness and stability.

Here are some reactions by people after they read the post.