Money is one of the stickiest subjects in partnerships. Who makes what, how to split the bills, and is there a way to have more?

The story shows that answering some of the tough questions can increase tensions within the relationship.

A significant amount of money came from a Redditor throw_709236‘s grandfather’s estate. She quit a job that made her miserable and pursued the passions that gave her the most joy.

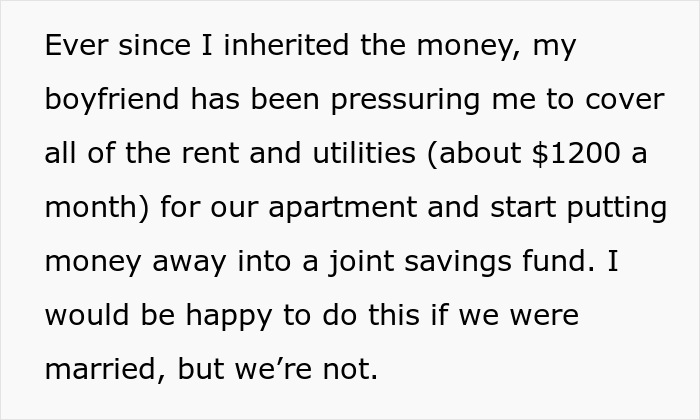

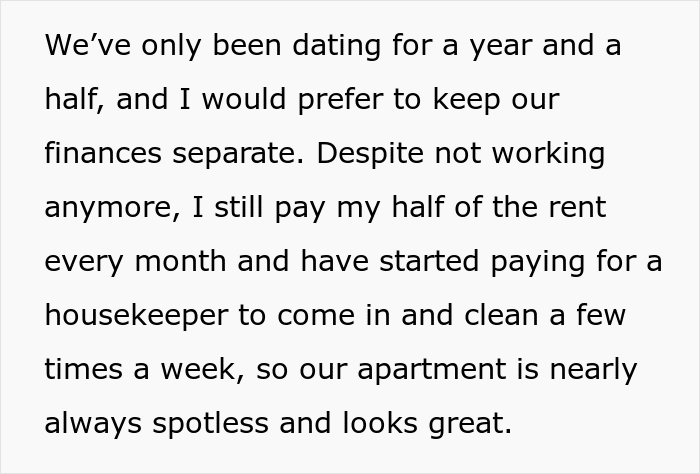

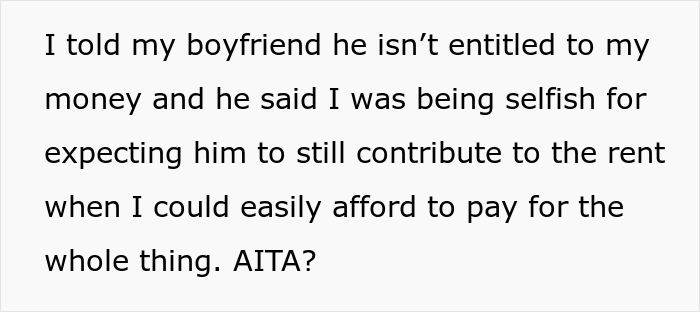

The situation got more complicated because the woman’s boyfriend wanted her to use some of her wealth to cover their rent.

The woman turned to the platform’s “Am I the [Jerk]?” community for advice after she refused.

A woman’s life was turned upside down after she received a large portion of her grandpa’s estate.

Her boyfriend thought she needed to pay their bills as well.

It is not clear what the right course of action is for this couple. According to experts at the National Bank of Canada, the 50/50 split works when both people are making the same amount of money. The distribution of expenses is more balanced if there is a significant salary gap between them.

The equation is very simple. All you have to do is calculate what percentage of total household income is earned by each person and then apply this percentage to the total monthly budget.

This hypothetical situation is an example. One of the spouses makes more than the other. The budget for the month is $5,000. How do they allocate the money? The spouse who earns $75,000 transfers $3,750 to the joint account and the other transfers the remaining $1,250. Each partner contributes to shared expenses based on their financial capacity.

Since this is an inheritance and the woman is no longer working, determining her yearly base can be difficult.

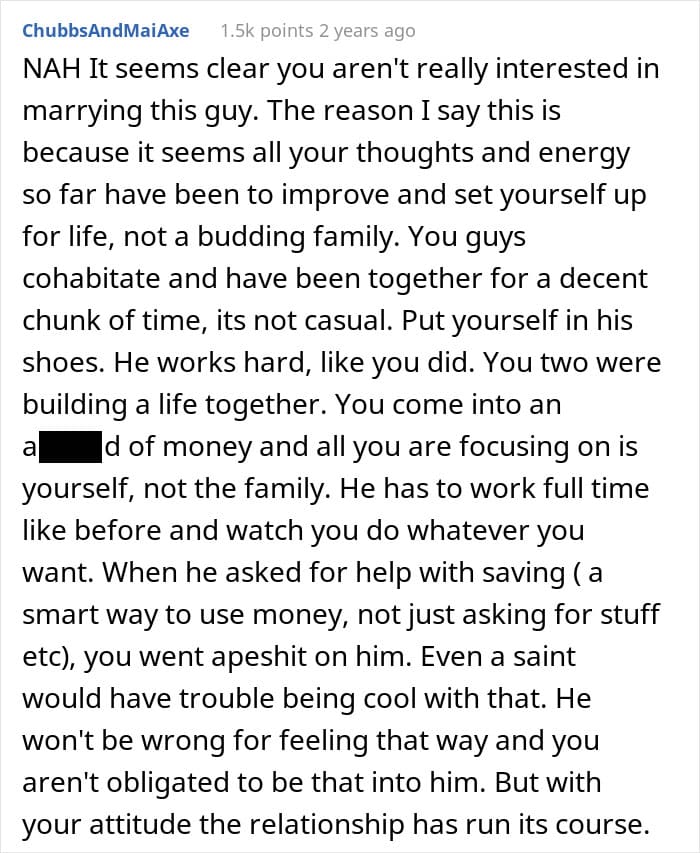

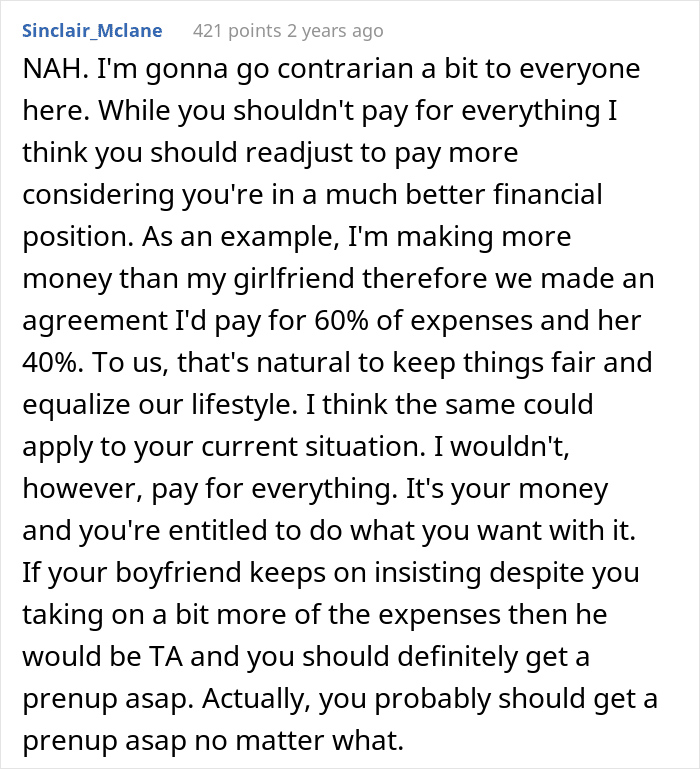

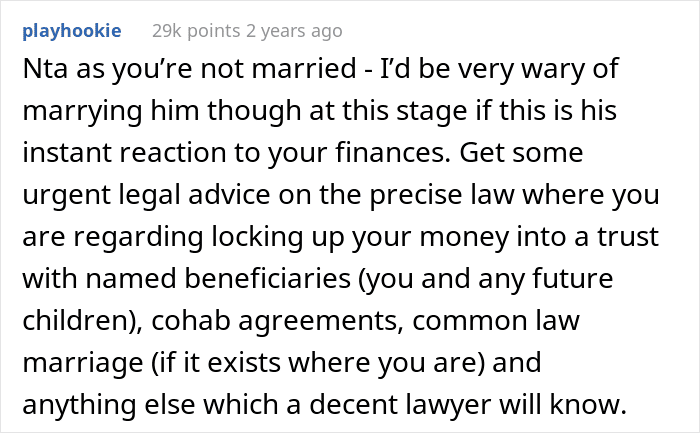

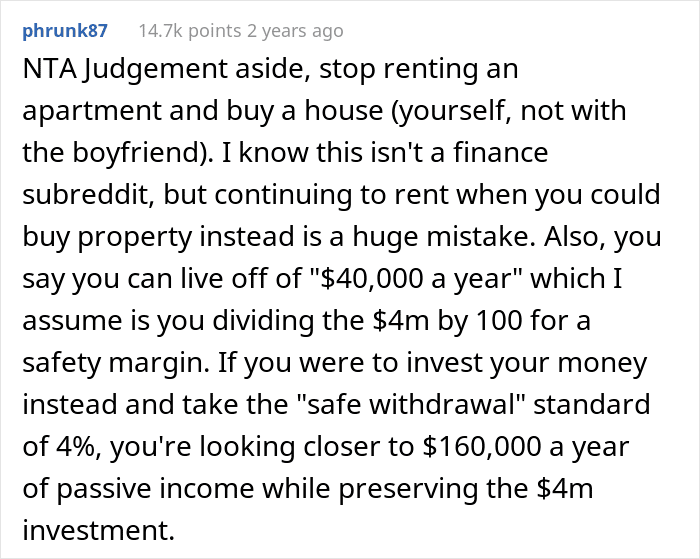

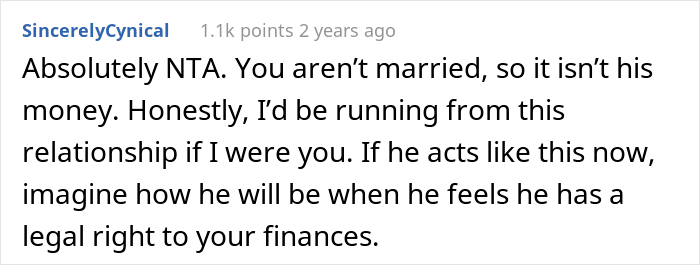

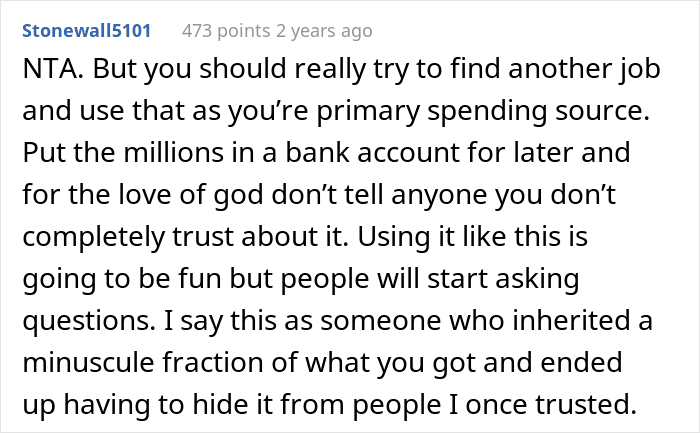

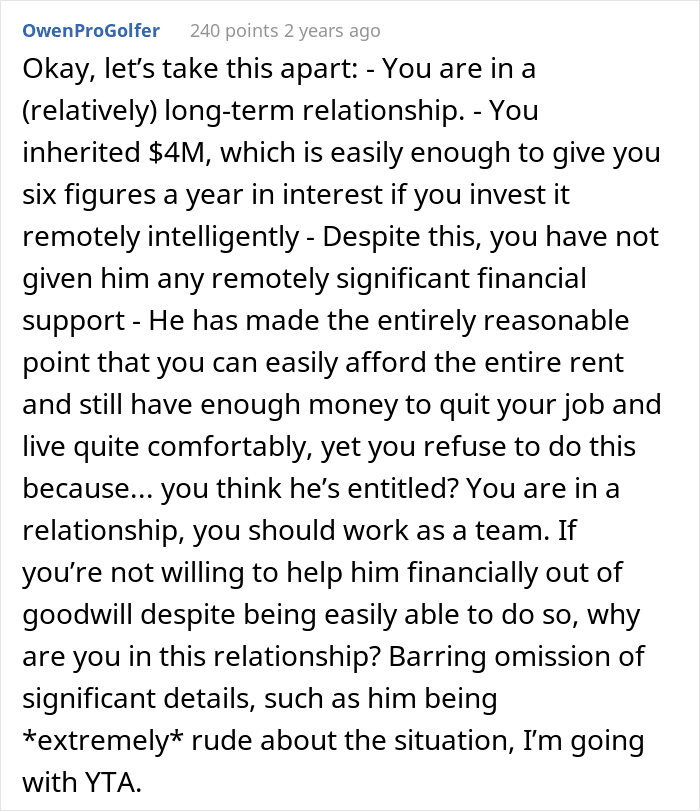

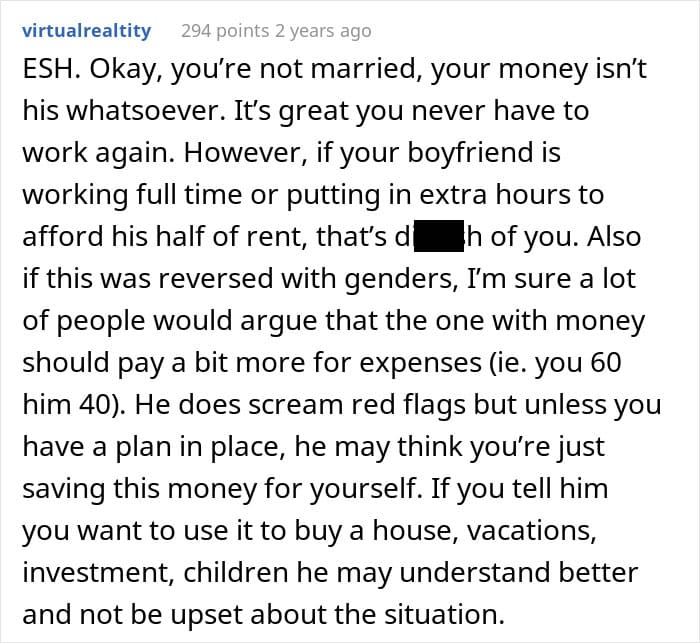

One group was in agreement with the woman.

These are important when you are in a relationship. According to a survey by The Cashlorette, 42% of Americans who are married or living with a partner argue over money. Most of the fights are about spending. A majority of people said that one person spends too much or the other is cheap.

Conflicts can have serious consequences. According to a study of more than 4,500 couples, they are the number one predictor of divorce. “Financial disagreements did predict divorce more strongly than other common problem areas like disagreements over household tasks or spending time together,” the people behind the research concluded.

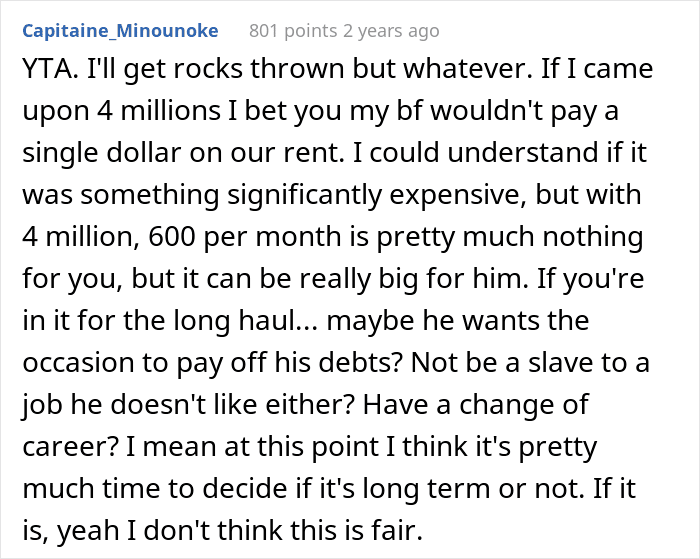

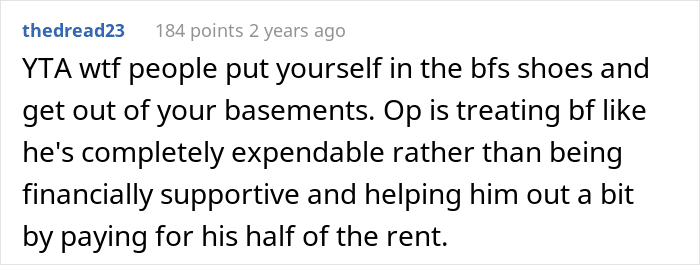

She was believed to be in the wrong.

Roughly 40% of people in a serious relationship don’t know how much their partner makes, according to data from a Fidelity study.

The results came despite the fact that 70% of respondents said they communicate well with their significant other and 25% said they communicate well with money.

Many couples aren’t willing to have honest discussions about money. “Life is busy and people don’t necessarily take the time to talk about their finances,” Stacey Watson, senior vice president of Life Event Planning at Fidelity, told CNBC Make It. “Money can be an uncomfortable topic.”

You can ask strangers on the internet for advice, but they don’t have the full picture. If you want to make an important decision, it’s probably best to sit down with your partner and talk about it.

There is no one answer for couples’ finances. You have to find something that works for you.

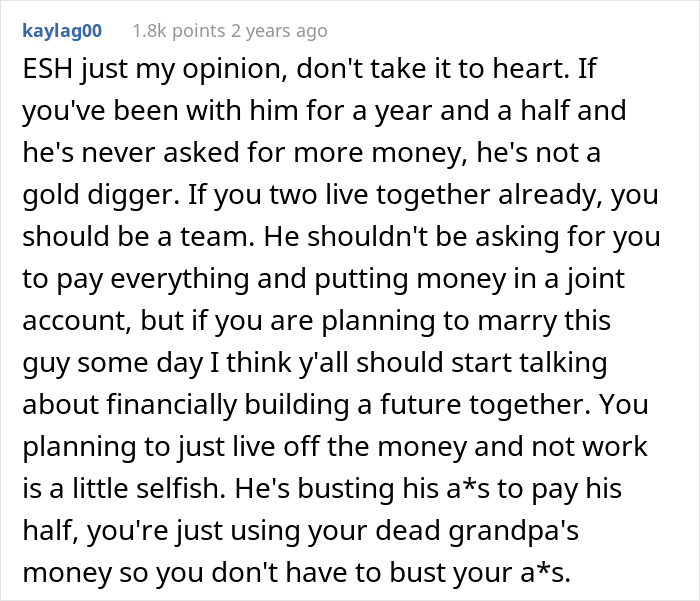

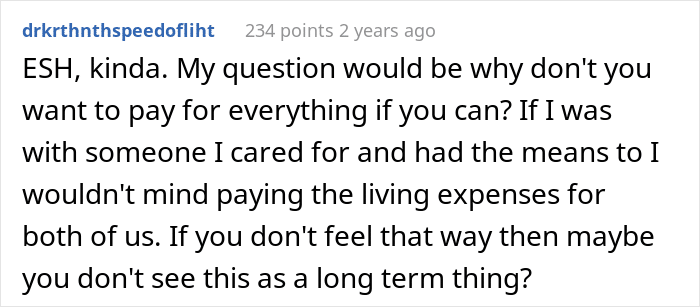

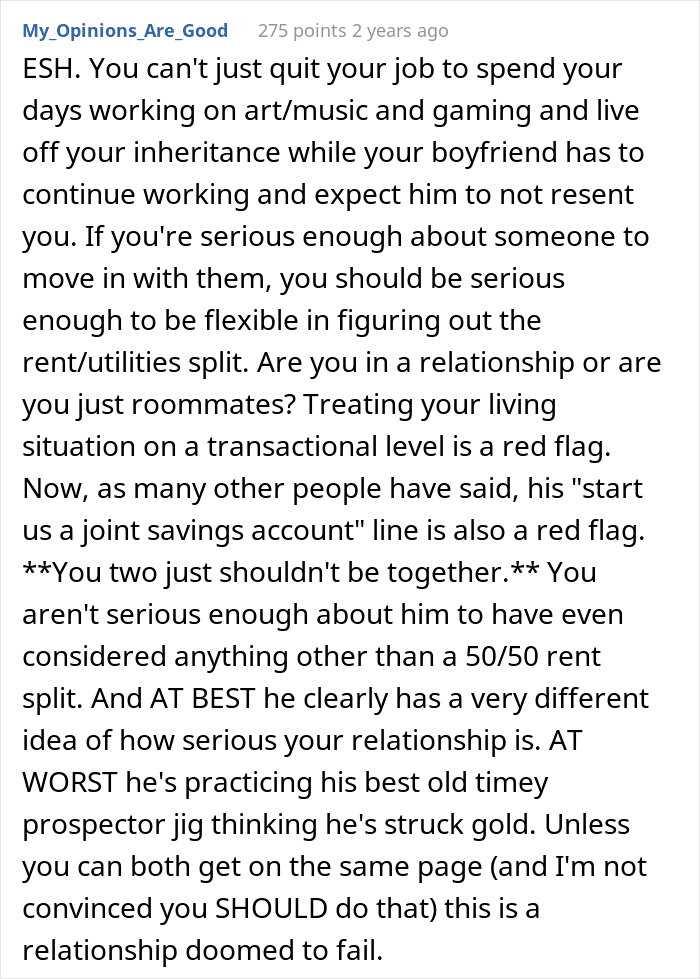

Some thought the couple was being unreasonable.

Specialists at Investopedia set up probably the most widely recognized issues and difficulties to pay special attention to assist with preparing better conjugal funds and connections:

- What’s mine, yours, and ours. Sometimes, when each spouse works and they can’t agree on financial nuances or find the time to talk about them, they split the bills down the middle.

Each spouse can spend what they want when the bills are paid. It seems like a reasonable plan, but it can build resentment over individual purchases. Spending power is divided, as well as the financial value of marriage, and the ability to plan for long-term goals such as buying a home or securing retirement. It can lead to financial infidelity if one spouse hides money from the other.

Bill parting likewise pushes not too far off any preparation and agreement working about how monetary weights will be dealt with in the event that one companion loses employment; chooses to scale back hours or accept a decrease in salary to evaluate another profession; passes on the labor force to bring up kids, return to school, or care for a parent; or on the other hand, assuming there’s some other circumstance in which one accomplice might need to monetarily support the other. Couples should have a conversation about such contingencies well before any of them happen.

- Debt. From school and car loans to credit cards and even gambling habits, most people come to the altar with financial baggage. If one partner has more debt than one other— or if one partner is debt-free— the sparks can start to fly when discussions about income, spending, and debt service come up.

Debts brought into a marriage stay with the person who incurred them and is not extended to a spouse. It won’t hurt your credit rating, which is linked to Social Security numbers and tracked individually. Most states that operate under common law owe debts incurred after marriage to both spouses. - Children. To have or not to have? That is usually the first question. Food, clothing, shelter, Little League, ballet, designer jeans, prom gowns, minivans, and college are all child-related expenses. Expenses are not included for offspring who have already left the nest. Your kids will leave the nest. Some never do.

Having kids isn’t just about the cost.

If one partner cuts their hours, works from home or leaves a career to raise children, couples should address how that changes marriage dynamics, assumptions about retirement, lifestyle, and more.

It is up to the couple to work things out, according to a few.